Dire Outlook for the U.S. Housing Market in 2019; Home Prices Could Fall

U.S. Housing Market Data Taking a Wrong Turn Thanks to Rising Interest Rates

The U.S housing market could be setting up to disappoint in 2019, all thanks to rising interest rates.

Long-term readers of Lombardi Letter have been warned before that as interest rates go higher, there are going to be victims.

Advertisement

Right now, the U.S. housing market is looking like it’s one of the biggest. We are seeing a lot of troubling developments that could impact much in the coming months and quarters.

Housing market data is becoming dismal, with home sales declining.

In November 2017, the annual rate of new homes sales was 712,000. In October of 2018, this rate stood at 544,000. (Source: “New One Family Houses Sold: United States,” Federal Reserve Bank of St. Louis, last accessed December 27, 2018.)

New homes sales have dropped close to 24% in less than a year. Mind you, in October, sales of new homes in the U.S. dropped to the lowest level since March 2016.

Homebuilders, who are close to the U.S. housing market, are getting nervous too. Just look at the Housing Market Index (HMI), tracked by the National Association of Home Builders and Wells Fargo & Co (NYSE:WFC). (Source: “Housing Market Index (HMI),” National Association of Home Builders, last accessed December 27, 2018.)

The HMI is essentially the result of a survey that asks homebuilders about the market conditions. This index ranges from zero to 100. A reading of zero means conditions in the markets are poor, while a reading of 100 means conditions are great.

In January 2018, the HMI stood at 72. In December, the reading was 56. That is quite the deterioration over a single year.

What does the HMI say? It’s saying that homebuilders are not as optimistic as they were in early 2018.

What’s Next for the U.S. Housing Market?

Let’s make one thing clear: higher interest rates mean that American home affordability declines.

As interest rates are going higher, mortgage rates are also increasing. For example, in late 2016, 30-year fixed mortgage rates stood at around 3.4%; now, the same rates are at 4.55%. This may not sound big, but it’s a huge increase in the grand scheme of things. (Source: “30-Year Fixed Rate Mortgage Average in the United States,” Federal Reserve Bank of St. Louis, last accessed December 27, 2018.)

It is now more expensive to get a house than it was two years ago.

Sadly, the Federal Reserve has made it clear that it will continue to raise rates. So you can expect mortgage rates to continue to go higher.

I am not going to be surprised if we start to see headlines saying something along the lines of, “Home prices decline in the U.S. for the first time since ____,” in the next few months.

If the housing market becomes a victim of interest rates, investors holding homebuilders’ stocks could face losses. We are already seeing homebuilder stocks tumbling, but more could follow.

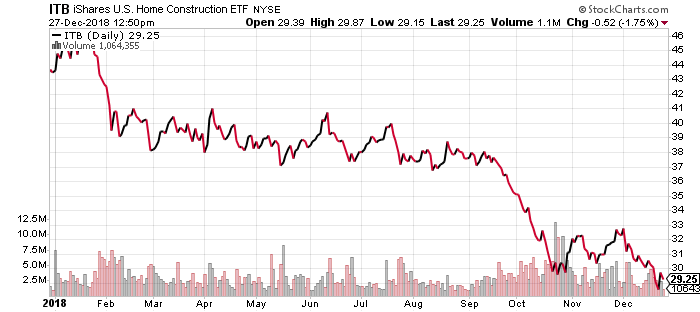

See the chart below of the iShares U.S. Home Construction ETF (NYSE:ITB), an exchange-traded fund (ETF) tracking homebuilders’ stocks. As you can see below, it has declined 33% over the last one year.

Chart courtesy of StockCharts.com

Also consider that the poor housing market could impact the overall U.S. economy, with declining sales and home prices potentially harming consumer spending and sentiment.

In conclusion, the housing market is currently being ignored, which could cause a lot of problems ahead in 2019.

U.S. Housing Market To Get Uglier In Near Future

The reasons for the housing market downturn are in the eye of the beholder, as we will see in a moment. But whatever the reasons for it may be, the data on the housing market is getting uglier by the month.

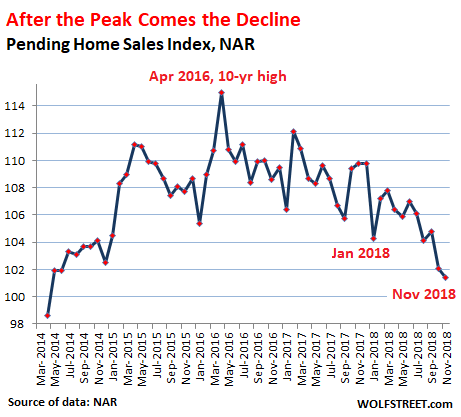

Pending home sales is a forward-looking measure. It counts how many contracts were signed rather than how many sales actually closed that month. There can be a lag of about a month or two between signing the contract and closing the sale. This morning, the National Association of Realtors (NAR) released its Pending Home Sales Index for November, an indication of the direction of actual sales to be reported for December and January. This index for November fell to the lowest level since May 2014:

"There is no reason to be concerned," the report said, reassuringly. And it predicted "solid growth potential for the long-term."

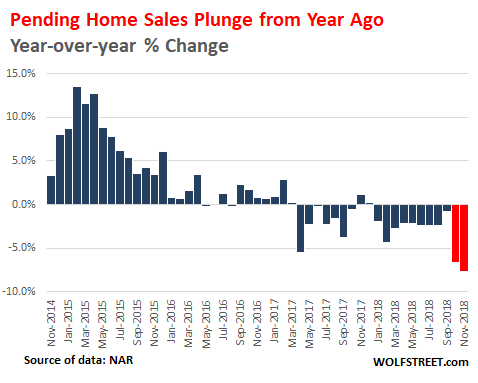

And the index plunged 7.7% compared to November last year, the biggest year-over-year percentage drop since June 2014. The drops in October and November are indicated in red:

All four regions got whacked by year-over-year declines:

- Northeast : -3.5%

- Midwest: -7.0%

- South: -7.4%

- West: -12.2%

The plunge in pending home sales in the West, a vast and diverse region, will prolong the plunge in closed sales for the region. Particularly on the West Coast, the largest and very expensive markets - Seattle metro, Portland metro, Bay Area, and Los Angeles area - have been experiencing sharp sales declines, a surge in inventory for sale, and starting this summer, declining prices.

Today's pending home sales data confirms that these trends are intact and will likely continue.

The NAR report blames the sales decline in the expensive markets in the West on "affordability challenges" - because prices "have risen too much, too fast," it said.

And this is a true and huge problem: Home prices have shot up for years, even while wages ticked up at much slower rates. At some point, the market is going to run out of people with median incomes who are willing to stretch to the limit to buy a starter shack, and the market is going to run out of people with high incomes who are willing to stretch to the limit to buy a median house.

For example, at the peak, the median house price in San Francisco was over $1.7 million. That median house is nothing fancy. And the market has run out of high-income people blowing so much money on a modest house. Hence prices have come down sharply over the past six months.

"Local officials should consider ways to boost local supply," the report says. Alas, there is all kinds of supply suddenly coming on the market. It's not that there isn't anything to buy; the problem is that everything is too expensive, and that sellers and buyers no longer see eye-to-eye.

But the decline in sales on a national basis, according to the report, is a "short-term pullback" that "does not yet capture the impact of recent favorable conditions of mortgage rates."

Sure, lower mortgage rates are a relief for buyers. But wait… according to the Mortgage Bankers Association, the average rate of conforming 30-year fixed-rate mortgages with a 20% down payment has dropped to 4.94% during the latest reporting week. This is 23 basis points off the high of 5.17% in early November.

But here is the thing: In January 2018, when the Pending Home Sales index plunged to the lowest level since December 2015 (indicated in the first chart above), the NAR blamed low supply of homes and surging mortgage rates.

Since then, supply has sharply increased, and mortgage rates?

Currently, the average 30-year fixed rate, at 4.94%, is still 54 basis points higher than it had been in January. And if an average mortgage rate of 4.4% was blamed for plunging home sales in January, then an average rate of 4.94% isn't going to suddenly boost sales.

There is a lot more at play here than just wobbling mortgage rates. At the top of the list are woefully inflated prices that potential buyers now see as such.

And these potential buyers are now also confronting the fear that prices will decline, or further decline, after they buy. This is a scary thought, given the amount of leverage and the large dollar figures involved in a home purchase. Potential buyers now see that after the purchase, those fears could translate into some real and long-lasting headaches.

In Seattle, house prices dropped 4.4% in four months, the biggest four-month drop since Housing Bust 1, according to the Case-Shiller Home Price Index. Prices also deflated in the San Francisco Bay Area, San Diego, Denver, and Portland.

Housing Bear Who Called 2018 Slowdown Says Worst Yet to Come

James Stack, who predicted the 2008 real estate crash and nailed last year’s housing slowdown with uncanny timing, is back with some bad news for 2019.

“Housing could be heading for its worst year since the last housing crash," Stack, 67, said in a phone interview. “Expect home sales to continue on a downward trend in the next 12-plus months. And there’s a significant downside risk to housing prices if a recession takes hold.”

Jim Stack

Source: InvesTech Research

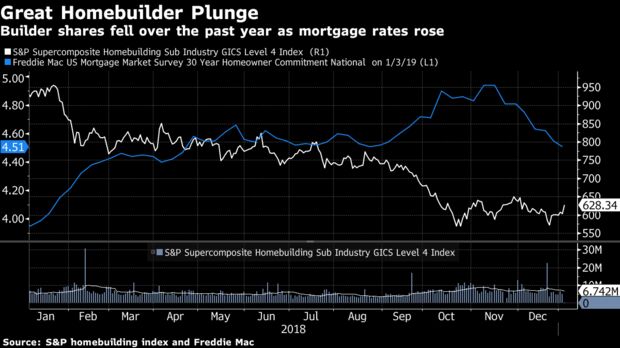

Last January, Stack was practically alone when he warned rising mortgage rates would expose housing’s affordability problem and “the risk that today’s highly inflated housing market will again end badly.” The day after Bloomberg published his comments on Jan. 22, homebuilder shares began a 10-day slide, and ended the year down by more than a third.

Almost a year later, the signs of coming distress in property markets -- and the broader economy -- are only increasing, said Stack. Home purchase contracts in the U.S. fell 7.7 percent in November, according to a National Association of Realtors index. Consumer confidence dropped in December. And a gauge of U.S. manufacturing plunged by the most since 2008, only a day after Apple cut its sales outlook, prompting investor worries about a global growth slowdown.

Stack, who manages $1.3 billion for people with a high net worth from his office in Whitefish, Montana, studies his fireproof files of newspaper articles on bear markets dating back to 1929. He predicted the housing crash in 2005, just before prices reached their peak. Last year’s warning came after Stack noticed that his "Housing Bubble Bellwether Barometer" of homebuilder and mortgage stocks was up 80 percent in a year, a sign that investors once again had gotten too "exuberant."

He says it’s too early to know if housing is in another bubble. It will depend on what happens with the economy. "Unfortunately, bubbles are only recognized with 100 percent certainty in 20/20 hindsight," he says.

To be sure, economic strength should be playing to housing’s benefit. While rates for 30-year mortgages peaked at 4.94 percent in November, climbing a percentage point since the start of 2018, they’ve since fallen to 4.51 percent. And the U.S. unemployment rate is near a five-decade low, with employers in December adding the most workers in 10 months.

But Stack says the damage is done.

"Even if mortgage rates level off or ease slightly in 2019, we are unlikely to see the psychology turnaround," Stack said. "Homebuyers have woken up to the fact that affordability is a major issue. Can they afford the home?"

0 comments:

Post a Comment