The Pension Benefit Guaranty Corp (PBGC) said in a Friday press release that it believes Sears Holdings Corp's "continuation of the plans is no longer possible" following the Company's October bankruptcy, after it was revealed in a Friday filing that Chairman Eddie Lampert's $5.2 billion rescue package does not include pension plans.

PBGC, a government agency, covers individuals' pensions in the event a pension plan shuts down without sufficient funding to meet its obligations. The Sears pension system, meanwhile, is underfunded to the tune of approximately $1.4 billion, which the agency could attempt to recover through the bankruptcy, according to MSN.

It should be noted that the PBGC is not supported by general tax revenues, rather, funding comes from four sources; insurance premiums paid by sponsors of defined benefit pension plans; assets held within the pension that PBGC takes control of; recoveries of unfunded pension liabilities from the bankruptcy estates of plan sponsors, and investment income. Sears entered into a five-year protection plan with the PBGC in 2016.

Ron Olbrysh, chairman of the National Association of Retired Sears Employees, said the guarantee means retirees aren't worried about losing pensions, but they do have concerns about other benefits."The pensions are secure through Sears or through the Pension Benefit Guaranty Corp.," he said. "The big impact if Sears does liquidate is that retirees will lose life insurance."The PBGC said it expects its guarantee will cover the "vast majority" of pension benefits earned under Sears' plans. Retirees who have questions about what the takeover would mean for their pensions can visit www.pbgc.gov/Sears-QA. -MSN

Until Sears agrees to terminate the pensions or the court orders them to do so, the Hoffman Estates-based retail giant will remain responsible for the plans, which the agency is looking to assume control of as of January 31.

Lampert - then the company's CEO, wrote in a September blog post that the company's pension obligations had become a major sticking point.

In addition to the very difficult retail environment, Sears has also been significantly impacted by its long-term pension obligations. In the last five years, we contributed almost $2 billion, and since 2005 we have contributed over $4.5 billion, to fund our Pension Plans....The reality is that, while we strongly believe in our vision and our strategy for the Company, we also have had to address the pressures that result from the unsatisfactory operating performance as well as the ongoing burden of our legacy pension liabilities. -Eddie Lampert

Sears confirmed on Thursday that Lampert's $5.2 billion rescue package had been accepted, preserving 45,000 jobs - but not the roughly 90,000 pensions the company is on the hook for. Lampert's offer will still require approval from US Bankruptcy Court in the Southern District of New York - while the company's creditors are already beginning to complain.

Kunstler: America's "All Is Lost" Moment Looms

Coming Attractions

“Last night I had a dream. You were in it and I was in it with you….”

— Randy Newman

As in this age of Hollywood sequels and prequels, America prefers to recycle old ideas rather than entertain new ones, so you can see exactly how the 2020 presidential election is shaping up to be a replay of the Great Depression, with Roosevelt-to-rescue! — only this time it’ll be with somebody in the role of Eleanor Roosevelt as chief executive. Donald Trump, of course, being the designated bag-holder for all the financial blunders of the past decade, gets to be Herbert Hoover. As was the case in the original, economic depression will segue into war, with maybe not such a happy ending for us as World War Two was.

There should be no doubt that the money part of the story is on a slow boat to oblivion. The world has been running on loans to such a grotesque degree that it’s managed the impressive feat of bankrupting the future. The collateral for all that debt was the conviction that there were ample amounts of future “growth” up ahead to service that debt. That conviction is now evaporating as car sales plummet, and real estate goes south, and nations twang each other over trade, and global supply lines wither. Globalism is unwinding — and not for the first time, either.

As in the standard Hollywood screenplay format, expect an “all is lost” moment when the “hero” (the USA) faces the existential dread of realizing that there is no more borrowing with the collateral gone. Translation: when the Federal Reserve discovers it can’t cue up yet another round of “Quantitative Easing” (QE) and ZIRP without destroying the value of the dollar — which it might do anyway, since monetary inflation is a great benefit to those who can’t pay back their debts, and the USA is the biggest deadbeat of all. An inflationary depression won’t be the same as the deflationary depression of the 1930s, but remember (cliché alert): history doesn’t exactly repeat, it rhymes. Financialization, it’ll turn out, was just money with its value removed. Imagine how pissed off the voters will be.

Note: the growth predicament is hugely misunderstood in this land, because the shale oil “miracle” was such a dazzling stunt. America is now producing above 12 million barrels of oil a day, two million higher than what was thought to be the all-time peak of 10 million a day in 1970. That is extraordinary indeed. We are the world’s leader in oil production now, ahead of Saudi Arabia and the wicked Russian bear. What most Americans don’t know is that this stunning feat was accomplished with hundreds of billions of dollars in borrowed money (debt) that will never be paid back.

The collateral for all that money was the conviction that there was a lot of money to be made in shale oil. But the shale oil industry has had a negative cash flow since it started around 2005. So, we’ve demonstrated that you can produce a lot of something at a big loss for a while, until you can’t. And the moment is approaching when there will be no more loans for the shale oil industry and then, voila, no more shale oil. And the USA will have a whole lot less of its primary energy “input” to the economy. We’ll be back to 2008. The turnaround will be fast and shocking and the American public will feel swindled. And having been already swindled out of all the other comforts and conveniences of what used to be modern life — a job, a home, a car — they will be even more supremely pissed off.

Enter stage left, the first woman president. Take your pick: Kamala Harris, Elizabeth Warren, Kirsten Gillibrand — with AOC as Speaker of the House! The new “Eleanor” will out-do Franklin Roosevelt in “innovative” economic policy. Only this time it won’t be jolly corps of brawny men marching off with pick-axes and shovels to carve trails through the national parks. It will be an orgy of collectivization, led by a gender-fluid army of commissars in an American sequel to the classic film Battleship Potemkin. Madam President will nationalize everything that’s not fastened down with square-head decking screws. Then the show trials will commence, first with the hated One Percenters going to the firing squads and then briskly moving to all the enemies of “intersectional justice.”

None of that will make the USA a better country. And then imagine how pissed off Russia and China will be when Madam President takes up her policy of exporting the New Bolshevism to other lands (because it works so well). Been there, done that, they’ll say. And maybe they’ll have to smack us down to get the point across.

Federal Reserve Confesses Sole Responsibility For All RecessionsIn a surprisingly candid admission, two former Federal Reserve chairs have stated that the Federal Reserve alone is responsible for creating all recessions in the United States.

First, former Fed Chair Ben Bernanke said that

Expansions don’t die of old age. They get murdered.

- MarketWatch

To clarify this statement, former Chair Janet Yellen placed the murder weapon in the Fed’s hands:

Two things usually end them... One is financial imbalances, and the other is the Fed.

Think that through, and you quickly realize that both of those things are the Fed. Is there anyone left standing who would not say the Fed’s quantitative easing in the past decade was the biggest cause of financial imbalances all over the world in history? Moreover, whose profligate monetary policies led to the Great Financial Crisis that gave us the Great Recession?

So, the Fed loads the gun with financial causes and then pulls the trigger. In fact, I think it would be hard to find a major financial imbalance in the US that the Fed did not have a hand in creating or, at least, enabling. Therefore, if those are the only two causes, then it is always the Federal Reserve that causes recessions by its own admission.

And, yet, those Fed dons look so pleased with themselves.

Yellen went on to say that when the Fed is the culprit, it is generally because the central bank is forced to tighten policy to curtail inflation and ends up overplaying its hand. (She didn’t mention that the Fed’s monetary policy may have a hand in creating financial imbalances.)

Exactly, nor did she mention that the inflation they were “forced” to curtail always happens because of financial imbalances the Fed created or enabled. That is why I call our expansion-recession cycles, rinse-and-repeat cycles. Therefore, the Fed is only forced by its own ill-conceived actions. First you have to create the imbalance, which causes the economy and stocks to inflate, then you have to pull the trigger to shoot that down by tightening into a recession, which the Fed always does:

Bernanke elaborated on Yellen’s point, accusing the central bank of, in essence, murder. It takes an aggressive act on the part of the monetary authority to bring an expanding economy to a halt and cause it to shift into reverse.

Yellen and Bernanke were speaking at the annual meeting of the American Economic Association in Atlanta earlier this month in the company of current Fed Chair Jerome Powell.

As I demonstrated in my two earlier articles this week (“Does Inverted Yield Curve Indicate Recession?” and “What is an inverted yield curve and what does it mean?“), the Fed carries out this act of econocide by getting the yield curve to invert via its forced interest changes. As shown in those articles, every recession has been immediately preceded by a Fed-created inversion of the yield curve — the Fed’s smoking gun.

The Fed Fix Is Almost In

As noted in those articles, today’s yield curve has already slipped into its penultimate inversion. First (on December third), three-year notes started paying more interest than five-year notes. (The five-year was at 2.83% interest, while the three-year hit just over that at 2.84%.) In essence, investors were betting the economy would be a tad better in five years than it would in three.

Within a matter of weeks, the three-year notes were paying more than seven-year notes. Then, just about Christmastime, they started paying more than eight-year notes, inverting the yield curve even further out. The orange recession indicator light comes on when they take the next step of paying more than ten-year notes; and above that we go full recessionary red! The first three came all within in a month, so the rest may come just as quickly.

In fact, we’re so close that one more rate increase by the Fed could pull the trigger. This is why Powell can be so reassuring about pulling back soon on targeted interest-rate increases. He knows he’s already operating with a hair trigger because of the Fed’s other tightening action in rolling bonds off of its balance sheet.

Like a skilled sharp-shooter, Powell recently said the Fed is “watching and waiting” before it pulls the trigger with its next rate increase. At the same time, he suggested his balance-sheet reduction won’t end for awhile (and, of course, the Fed knows that its balance sheet reduction is skewing the yield curve faster than the Fed’s targeted interest-rate increases.

I’ve said before that those interest-rate increases are now just playing verbal catch-up to what the balance sheet reduction is doing in the open market. In other words, the balance sheet reduction is pulling the Fed’s targeted interest rates up, regardless of what is says, so it is pressed to state it intends an increase just to keep up with the effects of balance-sheet reduction. Last summer the Fed tactic admitted this when…

The Fed raised the target range for its benchmark rate by a quarter point to 1.75 percent to 2 percent, but only increased the rate it pays banks on cash held with it overnight to 1.95 percent. The step was designed to keep the federal funds rate from rising above the target range. Previously, the Fed set the rate of interest on reserves at the top of the target range. -Bloomberg

In other words, the Fed had to change the way it calibrates some interest rates because other factors than their change in their stated target rate were driving rates up. In order to keep bank demand for Fed funds from pushing the rate above 2%, the Fed set its stated rate at 1.95% to create some headroom. That’s explained as…

Officials have said that, as they drain cash from the system by shrinking the balance sheet, a rise in the federal funds rate within their target range would be an important sign that liquidity is becoming scarce…. The increase appears to be mainly driven by another factor: the U.S. Treasury ramped up issuance of short-term U.S. government bills, which drove up yields on those and other competing assets, including in the overnight market.

And that is what is now happening, but they are still planning to keep tightening by reducing their balance sheet. What is not said there is that the major reason the US Treasury is ramping up its issuance of government bills is that the Fed’s unwind is forcing them to refinance maturing bills on the open market as the Fed now refuses to refi those bills. I’ve maintained for a couple of years that the unwind will drive up other interest rates, causing problems throughout the economy.

Gunsmoke And Mirrors

So, the Fed’s recent talk about reducing the number of rate increases in the Fed’s interest target is slight of hand because the Fed’s unwind is doing the heavy lifting here, driving up rates faster than the Fed changes its stated target rate. Powell assures everyone the Fed will slow down its interest-rate increases, even as the Fed pushes right ahead with its balance-sheet unwind, which is doing the most to invert the yield curve.

Powells only defense against concerns expressed about balance-sheet reduction was…

“We are looking carefully at that, and the truth is, we don’t know with any precision,” Fed Chairman Jerome Powell told reporters on Wednesday when asked about the increase. “Really, no one does. You can’t run experiments with one effect and not the other.”

Not too reassuring to hear the Fed Head say no one really has any idea what impact its balance-sheet unwind will have on other interest rates. Does the Fed not know, or does the Fed just not want to say what it does know?

For additional cover as to whether the yield-curve inversions the Fed creates will cause a recession this time as they did in all previous times, Yellen, protested, as I noted in an earlier article this week, that this time is different:

Now there is a strong correlation historically between yield curve inversions and recessions, but let me emphasize that correlation is not causation, and I think that there are good reasons to think that the relationship between the slope of the yield curve and the business cycle may have changed.

It’s not every day that the Fed admits total culpability for the death of every expansionary period. Nor that it admits that the inflation its expansionist monetary policies create force it to become the culprit. Nor that it routinely overplays its hand.

Apparently, the Fed Heads are so comfortable with all of this (hence the smarmy looks in their photos above) that the economic murderers can confess in broad daylight every murder they are responsible for with complete impunity, even as they tell you where the bodies are buried. However, because they still have their next economic massacre to commit right before your eyes and don’t want you to stop them, they wish to assure you that “we can’t possibly know what will happen” now or “this time is different. Things have changed.”

The words “I can’t know what will happen” when a gunslinger is twirling his cocked and loaded pistol with his finger on the trigger, should not give you comfort.

Perhaps all these confession now will enable them to smile even bigger when the slaughter is over, and they know they did it this time in broad daylight.

Of course, there is one major difference this time. In all previous times, the Fed didn’t have the most massive balance-sheet unwind pushing interest rates all around so it had to rely more on its conventional tool of incremental changes in the its targeted interest rate. The new existence of that big gun mean it can who you it is putting away the little gun to disarm you because it has a cannon pointing at you from just inside the woods to your left. Thus, Powell said disarmingly,

More rate hikes wasn’t a pre-set plan and the forecast of two moves was conditional on a “very strong outlook for 2019.” - MarketWatch

In other words, keep your eye on the rate hikes I keep talking about (the little gun), not on the big balance sheet reductions that we put on autopilot so we don’t have to talk about them. Like a great hunter, Powell said the Fed can be patient.

Some analysts believe the Fed’s runoff of its balance sheet is hurting financial markets and want the central bank to end the program.

Gee, ya think? A runoff that intends to force the US government to refinance an additional $2 trillion over the next 3-4 years on the open market might be hurting financial markets more than a quarter-point increase in the Fed’s interest target every few months?

One analyst who disagrees with Powell is Peter Boockvar, chief investment officer at Bleakley Advisory Group:

“It’s no coincidence that accidents begin to pick-up the deeper you get into tightening … QE inflated markets to very high valuations. It’s wishful thinking to believe QT isn’t going to have an impact.”By shrinking its balance sheet, the Fed is draining the liquidity that sent stocks booming. - CNN

Some of the Fed’s colleagues at other central banks also agree and express concern about what this will do to them:

Last month, Irjit Patel, the governor of the Reserve Bank of India, pleaded with the Fed to slow plans to shrink its balance sheet. If the Fed doesn’t shift course, “a crisis in the rest of the dollar bond markets is inevitable,” he wrote in an op-ed in the Financial Times.

Other Fed members are just as aware of the Fed’s institutional murder rates as Bernanke and Yellen. St. Louis Fed President James Bullard told the Wall Street Journal this month that a recessionary risk is being telegraphed by what is now happening in the yield curve and that the Fed is causing the flattening of the curve toward inversion. So, these guys all appear to be well aware of what they are doing.

However, to maintain the distraction, Bullard also said,

In separate remarks to reporters …. he was open to a revisiting the balance sheet runoff but doesn’t think it is damaging markets as some argue. Bullard [said] that if the balance sheet runoff was impacting bond market as some suggest, then yields would be moving higher instead of the steady decline seen since November.

The latter would be happening, except that money has been pouring rapidly out of stocks and into bonds due to the rate increases the unwind created in September and October. What he ignores is the fact that rate increases were so substantial they sucked massive amounts of money out of the stock market in a flood of capital flight because all of a sudden treasury interest looked quite enticing. That, of course, pushed those rates down some in November.

So, “Nothing to see there, folks. Keep your eye on the little gun; and, oh, did we tell you that we have murdered every economic expansion in history?”

Who’s your daddy?

Now that we’ve heard the confessions from the murderers and have experienced the diversions that will allow the next murder to happen as much in plain sight as the confessions just happened, let’s look at the case from another angle: What has been keeping the stock market alive and hopping over the past decade?

Let me lay out evidence that it is clearly the Fed.

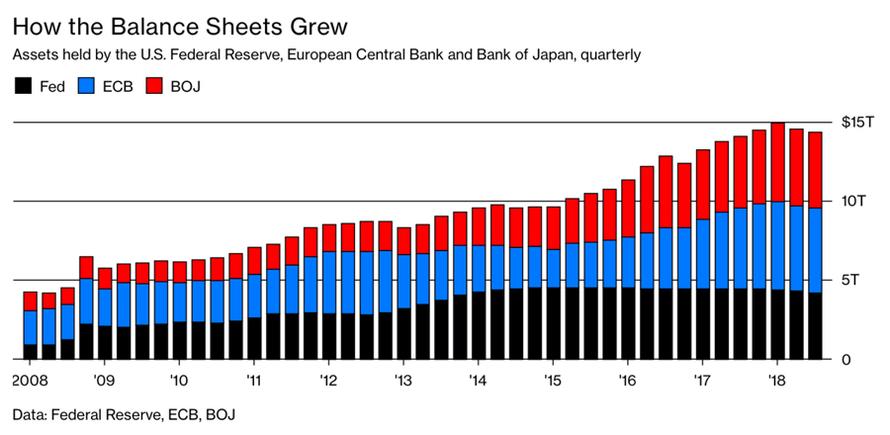

Exhibit A: What turned around the market’s major crash in 2009? The Fed’s QE1. Does anyone think the market would have turned around without that massive intervention? Was that intervention with hundreds of billions of dollars mere window-dressing, or was it the greatest financial intervention to a financial crisis the world had ever seen?Exhibit B: What turned the market around the next time it “corrected” as soon as QE1 ended? Was it not instant QE2? More hundreds of billions of dollars?Exhibit C: What saved the market when Republicans played roulette with the nation’s credit rating in the summer of 2011 and shot themselves in the foot politically when Standard & Poor’s gave the nation its first credit downgrade before Republicans even had the chance to let the nation default? Was it not the immediate promise of an ever bigger, indefinitely ongoing new kind of QE called Operation Twist, which morphed into QE3?Exhibit D: Then, when markets tumbled in 2015 and 2016, because the Fed was backing off from monetary stimulus, their colleagues in other countries jumped in with their own QE. More than $5 trillion worth in 2016! All told, the world’s central banks have pumped in $15 trillion since then.

But now they are all stopping!

Exhibit E: The prosecution presents a full picture of all central-bank stock salvation:

The Fed may claim that it does not attempt to rescue markets and that it looks only at economic indicators, yet somehow every time the market took a major plunge in the graph above, the Fed was instantly on the scene with a new invention of monetary stimulus in massive doses. Of course, “correlation is not causation.” Correlation is pretty interesting, though, especially when it happens at every plunge, except the one at the top that is plunging much further than any other time on this graph … because one thing IS different: No one is stepping in with salvation this time.

If the Fed has been the salvation of the market again and again, lifting it higher and higher, what happens if the Fed and other CBs let the stock market drop? Do you think they won’t do that? The highest authorities in the Fed just told you they did it every other time. First, they create massive “financial instability,” as Yellen said, otherwise known as “bubbles,” which grow due to the Fed’s infinite capacity to create monetary stimulus. They let these grow until inflation finally “forces” them to tighten until they crash them.

The prosecution presents Exhibit F:

This one is the Fed and all its major partners in crime. When did stock markets start to plunge all over the world? Wasn’t it as soon as global QT started to reverse at the end of that graph in 2018? Ah, but “correlation is not causation.” Except that it kind of is when you keep finding correlation everywhere you turn.

If the defense wants to argue the US market is not utterly dependent on the Fed’s constant protection, let me ask, “What did the market do in September of 2018 when the Fed removed one little word from its market-soothing speeches? Accommodative. Just as it watched its balance sheet-reduction up to full rewind speed.” It took its biggest plunge by far in the entire ten-year recovery period. As nearly everyone was saying, nothing bad suddenly emerged in the economy. All that changed was the Fed to merely implying it would be less accommodative to market concerns as it moved to full unwind.

If you still think the Fed isn’t going to kill the economy this time, I have one more question for you: When was the last time the Fed raised rates in the middle of a major market “correction?” How about never. Yet, now it is raising rates and reducing money supply via balance-sheet reduction at the same time that it hints it is removing accommodation.

But balance-sheet reduction doesn’t matter, right?

“We don’t believe that our issuance [new bond to replace those rolling off the balance sheet] is an important part of the story of the market turbulence that began in the fourth quarter of last year. But, I’ll say again, if we reached a different conclusion, we wouldn’t hesitate to make a change,” Powell said. “If we came to the view that the balance sheet normalization plan — or any other aspect of normalization — was part of the problem, we wouldn’t hesitate to make a change.” - MarketWatch

In other words, “Don’t look at the big gun. Nothing to see there.” Said the people who have just told you that none of their expansions ever ended until they murdered it!

Does the Fed have motive?

Don’t ask me why the Fed will kill its own recovery. It is enough that it admits it always does. So, I’ll leave determining which of the many possible “why’s” up to you. Maybe the Fed will cop an insanity plea and say that even it doesn’t know why it does the things it does. Whatever their actual motive, this sure has the Fed’s unswerving M.O. all over it. It has their fingerprints and their multiple confessions of guilt.

Still, let me lay out a couple of motives that are popular among those many people attribute to the Fed just to show there are plenty of possible motives out there:

Maybe the Fed’s member banks, who own and run the Fed (as its only shareholders and as governing board members who have huge influence over who the additional government-appointed board members are), like to repossess things. That would be a motive.

Or maybe they want to create a new cashless, digital, global monetary system. That would be a motive.

Or maybe, if they can crash things as perennially as Japan has done for score or more of years, they can get permission to start buying stocks directly, and use their infinite money supply, as Japan, has done to take major ownership in all the stocks of the nation.

Numerous conspiracy theories spend entire books making a strong case for different motives. I won’t land on one, but will note that all that matters is that there are plenty of motives to choose from.

Sure, Yellen protested that “correlation isn’t causation,” but, on the other, she admitted causation by saying that, when the Fed is the culprit, it is generally because the central bank is forced to tighten policy to curtail inflation — inflation that only the Fed causes by creating trillions of dollars monetary stimulus. There only struggle this time to stay within their M.O. is that they have failed to create inflation in the general economy that they are supposed to govern. Maybe that is why they have pushed the expansion into the longest in history because they are obsessed with following their usual M.O., and inflation didn’t cooperate this time to “force” them to tighten into recession (their cover story).

So, we have multiple confessions of murder by known Fed ringleaders. We have numerous pieces of circumstantial evidence that support their confessions. We have many possible motives. And, even the fact that the Fed continued pushing expansion longer than it has with more and more rounds of QE can be explained by its M.O. How many times has the Fed said they don’t understand why they couldn’t get inflation to rise to their 2% target for years. They could hardly claim inflation concerns when everyone knew CPI was under the target they’ve always said they want. Now it’s there. So, everything is in place.

I rest my case.

0 comments:

Post a Comment