Is the End of the U.S.

Dollar Nearing? Here Are Few Reasons Why That Might Happen

Confidence in the U.S. Dollar

Seems to Be Dwindling

The end of

the U.S. dollar could be nearing…

This may

certainly sound like an overly dire warning, but it is true. Know that this is

not just a gut feeling. This argument is backed by a lot of data and

developments.

Before

going into any details, we have to ask, why is the U.S. dollar so well recognized?

You

see, this is because the U.S. dollar is used for global trade and payments, and

central banks hold it in their reserves. There’s confidence in the U.S. dollar.

Now,

the big question: What do you think will happen if, all of a sudden, major

countries around the globe decide to question the way the U.S. dollar is

used? It could have detrimental effects on the greenback.

That is

what’s happening these days. The value of the U.S. dollar is being

questioned.

Look at

Russia.

The

country’s Prime Minister, Dmitry Medvedev, said that the U.S. actions are

incentivizing de-dollarization:

This is probably the

paradox of the current situation. And the paradox is that the idea of

de-dollarization receives constant incentives from the issuer itself…Obviously,

the trend to reduce dependence of national economies on the dollar will only

increase. Economic actions such as sanctions and protectionism of the most

powerful player in the economic arena only increase tensions.

Russia is also focused on non-dollar denominated trade.

Over the

past few years, the country has built a strong relationship with China and is

trading with China using the yuan. Russia has even bought the Chinese yuan for

its reserves.

Why should

you care? Russia is the 12th biggest country in the world and China is the

second-biggest hub in the global economy. If these countries are ditching the

U.S. dollar for trading, don’t you think other countries will follow?

Central Banks’ Yuan Reserves Increase by 78%

Mind you,

we are seeing an emergence of the Chinese yuan as a currency that a lot of

central banks and countries are leaning toward.

Look at

central banks, for example. They are increasing their Chinese yuan reserves. At

the end of the third quarter of 2018, they had $192.54 billion worth of Chinese

yuan in their reserves. In the same period a year ago, this figure was $108.16

billion.

So, over

a one-year period, their reserves increased by 78%!

Dear

reader, know that the only thing keeping the U.S. dollar up is the confidence

among governments, central banks, businesses, and investors that it has some

value. There’s really nothing else beyond that.

The day

this confidence breaks, you can say goodbye to the greenback. The examples

above show that there are cracks in the confidence. And know that these are not

the only developments that show a loss of confidence in the U.S. dollar.

I am

watching the U.S. dollar closely. If you follow this publication closely, you

will know I don’t believe in the “outright collapse” thesis for the dollar. I

believe we are going to see gradual declines in the value of the dollar at

first, and then we are going to see selling escalate once it fails to stay

strong.

If you

hold the U.S. dollar, I’d be very careful in the coming years.

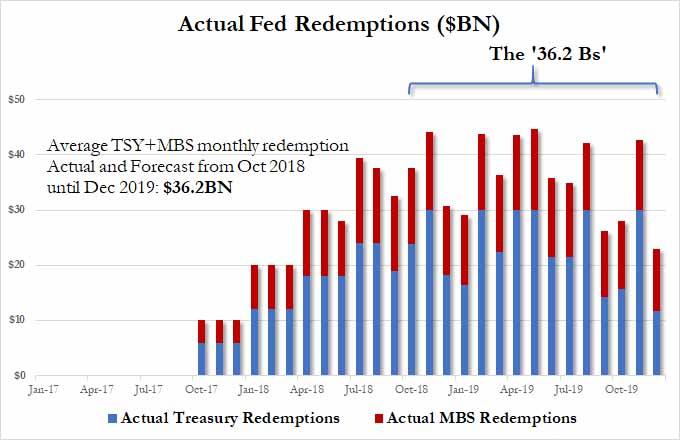

With activist central banks once again backstopping markets during the recent bear market scare, which prompted Fed Chair Powell to turn from a hawk to a "patient" dove in just a few weeks, markets, traders and economists have turned their attention to the biggest driver of risk, namely the Fed's balance sheet, which after expanding for the better part of the past decade has been shrinking at an "autopilot" pace of roughly $36 billion per month ever since it hit its "peak shrinkage" in Q4 of 2018...

... and prompted a barrage of media coverage in recent days including the following:

- from Reuters: Powell faces early reckoning on Fed's $4-trillion question

- from the WSJ: A $4 Trillion Scapegoat for Market Volatility: the Fed’s Shrinking Portfolio

- and from Bloomberg: Fed Balance-Sheet Fracas Highlights Confusion Over Market Impact

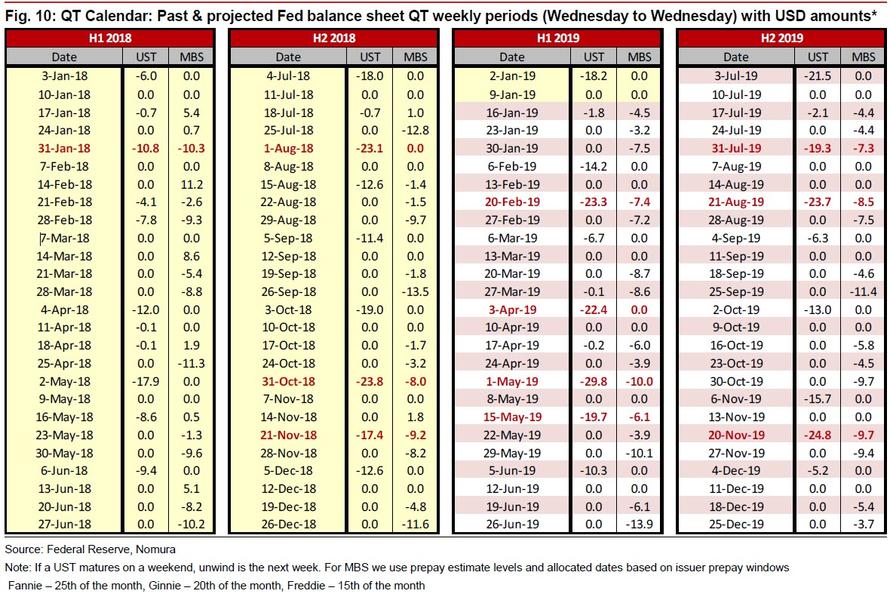

It is therefore hardly a coincidence that just over a week ago, JPMorgan's head quant Marko Kolanovic said that there is one chart that "traders tape to their screens, blogs and email chains", namely the complete QT calendar consisting of past and projected Fed Balance sheet QT weekly periods, such as the one shown below courtesy of Nomura's George Goncalves. The reason why this schedule matters, is because - whether due to a self-fulfilling prophecy or some other liquidity soaking market dynamic - on days when the Fed's balance sheet shrinks whether due to Treasury or MBS maturity, think of it as a reverse POMO, risk assets are hit.

Adding fuel to the dovish fire was a Friday article in the WSJ which said the Fed is considering a quicker end to its balance sheet runoff which has caused so much market anxiety and volatility. According to the WSJ, Fed officials "are close to deciding they will maintain a larger portfolio of Treasury securities than they’d expected when they began shrinking those holdings two years ago, putting an end to the central bank’s portfolio wind-down closer into sight." The article also added that "officials are still resolving details of their strategy and how to communicate it to the public" however, "with interest rate increases on hold for now, planning for the bond portfolio could take center stage."

So with so much of the market attention once again falling on the the Fed's balance sheet especially in the aftermath Powell's recent dovish U-turn, there is a palpable expectation that tomorrow the Fed will announce it is nearing a decision on when to end the reduction of balance-sheet holdings, essentially a pause in the quantitative tightening cycle.

However, as Bloomberg's Vincent Cignarella warns, the difference in what the Fed says and what the markets hear may once again be on display during Wednesday's press conference. Indeed, the Fed has previously said the fed funds rate is the central bank’s primary monetary policy tool, not the balance sheet. As such, if the Fed holds to this mantra, investors looking for comments curtailing the balance sheet runoff may be "massively disappointed" according to the Bloomberg macro commentator.

He is not alone. In a note released by Bank of America overnight, the bank's strategist expect the Fed to deliver a message of patience on Wednesday, but they are "skeptical it will be as dovish as the market expects."

While the bank expects the Fed to remove the perceived calendar guidance of "further gradual increases" and replace it with more data-dependent language during tomorrow's meeting, which will not have an update of the Fed's Summary of Economic Projections (SEP), BofA does not expect Powell to make any formal announcements during his press conference on the balance sheet, "which risks disappointing some market participants."

At a minimum, Powell will reiterate his recent comments that the Fed is willing to be flexible with the balance sheet if it was seen as interfering with the normalization process or if economic conditions were to warrant an adjustment. He may also address the technical reasons for adjusting the path of balance-sheet normalization. Powell will have to balance how much additional detail to provide on the balance-sheet framework based on the progress of internal deliberations, however that's as far as he will go, and will stop well short of validating the WSJ story of an imminent halt in QT.

So how should markets adjust their expectations?

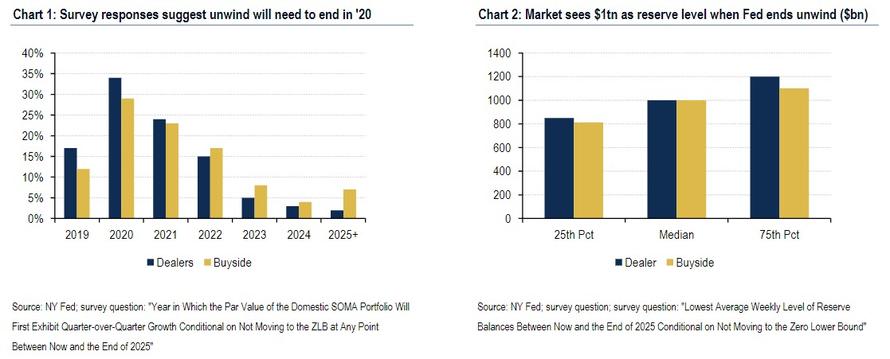

One of the first questions to address according to BofA is whether the Fed has embraced an "abundant reserve" regime (aka a floor system), which would imply a relatively large balance sheet vs the pre-crisis "scarce reserve" regime. Based on recent FOMC meeting minutes, Fed officials are leaning toward a floor system, and Powell may confirm this preference in his press conference, but note the Committee is still deliberating key balance-sheet details with the intention to provide more guidance at upcoming meetings. The market has already signaled to the Fed an expectation that it will need to maintain a relatively abundant reserve regime and that the unwind likely will not last beyond 2020 with around $1tn in reserves...

... which however is a problem as it suggest at least another $1 trillion, or a little under two more years of rolloff.

Where the market may be especially disappointed is in its expectations for additional detail on balance sheet (1) cessation conditions and thresholds and (2) composition in the longer run. A few thoughts from BofA on each:

- Cessation conditions and thresholds: the two conditions that could cause the balance-sheet unwind to end will be material (1) deterioration in economic conditions and (2) tightening in money or broader financial markets (i.e. the Powell Put). However, the thresholds for these considerations are uncertain.

- Longer run balance-sheet composition: the Fed has already suggested it prefers a portfolio of mainly Treasury securities (ie, not MBS) but has provided limited guidance on what this composition might look like. BofA expects the Fed will look to reduce the maturity of its Treasury portfolio to be in line with outstanding Treasury debt or to be similar to pre-crisis levels. Either way, the shortening of its UST holding tenor should favor a steeper UST and flatter spread curve all else equal.

The other key detail the market is looking for on the Fed's balance sheet is how the FOMC will ultimately transition to stopping the portfolio unwind. Specifically, the market would like to know if the Fed is going to taper its monthly reductions or stop cold turkey, a question that featured prominently in recently declassified deliberations from 2013 FOMC meetings. This question will likely depend on how willing the Fed is to stop the balance sheet early and take potential political criticism for being too accommodative to markets. If the Fed wanted to taper its reductions it would likely consider reducing the caps on its monthly redemption amounts for USTs and MBS or potentially just stop the UST portfolio reduction while allowing ongoing MBS redemptions. The Fed is likely to eventually lean toward this tapering approach since it is likely very uncertain as to the appropriate level of reserves in the banking system.

* * *

Besides providing details on the end of QT, one other place where the rates market may be disappointed is in just generally dovish the Fed would sound. One look at the latest Fed Funds shows that the rates market is widely expecting the FOMC to keep rates on hold at the January meeting and send dovish signals on both the outlook for rates as well as the balance sheet. However, BofA believes that the "Fed will be challenged to deliver a sufficiently dovish message to the market that risks a flatter curve and lower long-end rates."

While it is true that Fed policy maker communications have taken a decidedly dovish shift over the intermeeting period, most commentators doubt the Fed is yet ready to fully abandon its plans for further rate hikes later this year. If the Fed retains a soft hiking bias in the policy statement as discussed above, the market will likely need to assign higher odds to a Fed rate increase later in 1H19 beyond the current 5bp of hikes priced through July. These communications would also likely send long-end nominal and breakeven rates lower due to policy error concerns. Overall, the Fed is likely to retain some optionality to raise rates later in 2019, which risks sounding less dovish vs market expectations.

Going back to the balance sheet, BofA also believes that the Fed may disappoint market expectations here too. Based on the bank's reading of the December FOMC meeting minutes, the Fed likely has a number of important decisions it needs to make before it is willing to signal an imminent end of the balance sheet reduction. As such it is unlikely that the Fed is ready to adjust anything in writing around the balance sheet, which suggests no material language changes on the balance sheet in the FOMC statement, implementation note, or policy implementation plans and principles. This will likely disappoint those who interpreted the WSJ article as a signal from the Fed that the end of the balance-sheet unwind is rapidly approaching. As a result, BofA suspects that "risk assets may react negatively to the lack of balance-sheet guidance and contribute to a further flattening of the rates curve."

To summarize: the Fed will likely be challenged to deliver a sufficiently dovish message vs market expectations, which risks a sharply negative reaction in stocks, a flatter rates curve and a risk off USD reaction.

* * *

The above should make intuitive sense: after all, the Fed engages in either dovish jawboning or actual easing only when risk assets are sufficiently depressed to merit it, such as when the S&P was trading just above 2,300 after the "Mnuchin Massacre" last Christmas Eve. Now, with the S&P is 300 points higher, there is no need for any "emergency" intervention by the Fed, either verbal or otherwise.

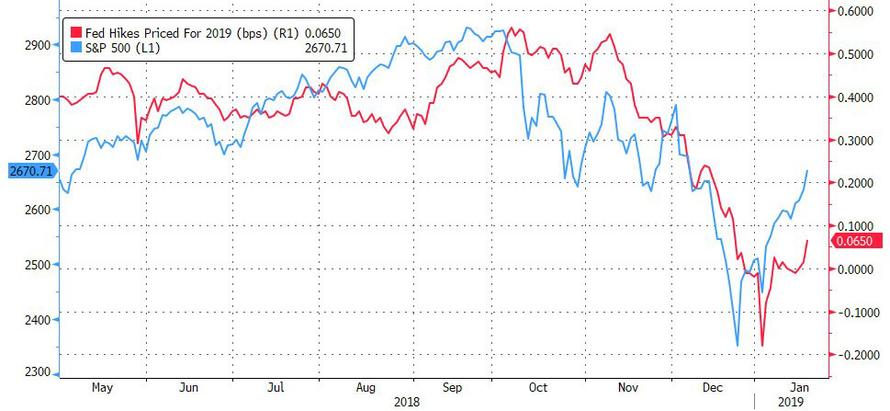

And in keeping with the reflexive nature of the market which has rebounded sufficiently in recent weeks to push rate hike odds for 2019 back into the green, and away from an expected rate cut...

... Nomura's Charlie McElligott provides yet another reason why the Fed may disappoint markets tomorrow, and it has to do with the ongoing "standoff" between markets and monetary policy:

As the data stabilizes (which it is currently attempting now, with Citi U.S. Economic Surprise Index pivoting back “positive” to+1 from -25 on Jan 3rd) or even accelerates higher, we re-enter that "tighter financial conditions" negative feedback loop, as the Fed is ultimately forced back-into the picture;

Conversely, if the data were to again slow further from here, it confirms that “glass half-empty” current investor view that “the best is behind us” and that we have “overtightened ourselves into a slowdown”

Essentially, for the Fed to "get more dovish" at this point - which also includes potentially conceding on balance sheet tapering - it would require a major downdraft in U.S. economic data or another market volatility spasm—which is NOT something that is going to help the mood. BofA agrees with this, and notes that "a broader decline in risk assets could also cause the Fed to reconsider its balance-sheet plans, particularly if it believes that the balance sheet policy is a culprit for market stress."

Stated simply, for the Fed to be ready to announce a pause, or end, to Quantitative Tightening, stocks have to tumble once again, just so they can then be then rescued again by the Fed during the next sharp market drop.

No comments:

Post a Comment