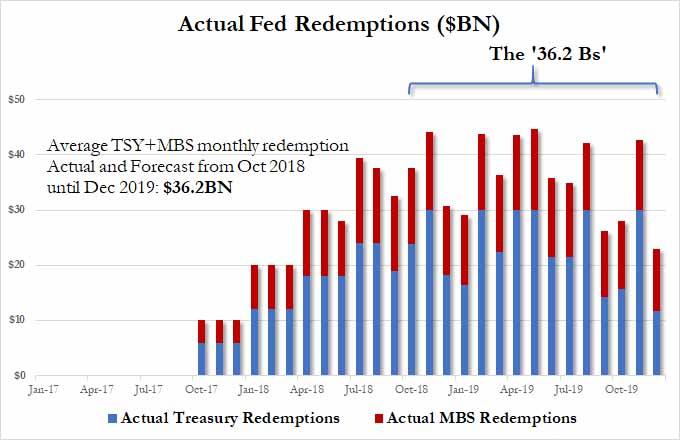

With activist central banks once again backstopping markets during the recent bear market scare, which prompted Fed Chair Powell to turn from a hawk to a "patient" dove in just a few weeks, markets, traders and economists have turned their attention to the biggest driver of risk, namely the Fed's balance sheet, which after expanding for the better part of the past decade has been shrinking at an "autopilot" pace of roughly $36 billion per month ever since it hit its "peak shrinkage" in Q4 of 2018...

... and prompted a barrage of media coverage in recent days including the following:

- from Reuters: Powell faces early reckoning on Fed's $4-trillion question

- from the WSJ: A $4 Trillion Scapegoat for Market Volatility: the Fed’s Shrinking Portfolio

- and from Bloomberg: Fed Balance-Sheet Fracas Highlights Confusion Over Market Impact

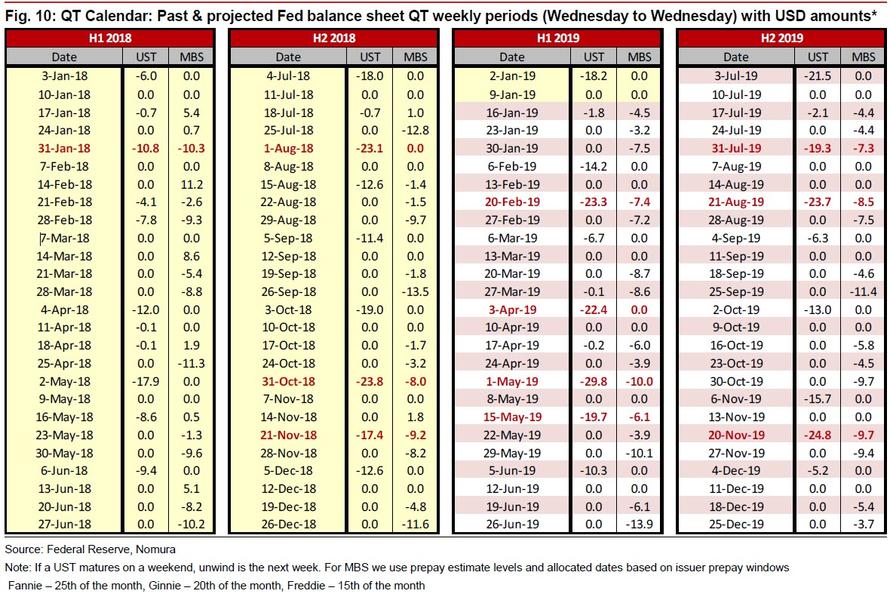

It is therefore hardly a coincidence that just over a week ago, JPMorgan's head quant Marko Kolanovic said that there is one chart that "traders tape to their screens, blogs and email chains", namely the complete QT calendar consisting of past and projected Fed Balance sheet QT weekly periods, such as the one shown below courtesy of Nomura's George Goncalves. The reason why this schedule matters, is because - whether due to a self-fulfilling prophecy or some other liquidity soaking market dynamic - on days when the Fed's balance sheet shrinks whether due to Treasury or MBS maturity, think of it as a reverse POMO, risk assets are hit.

Adding fuel to the dovish fire was a Friday article in the WSJ which said the Fed is considering a quicker end to its balance sheet runoff which has caused so much market anxiety and volatility. According to the WSJ, Fed officials "are close to deciding they will maintain a larger portfolio of Treasury securities than they’d expected when they began shrinking those holdings two years ago, putting an end to the central bank’s portfolio wind-down closer into sight." The article also added that "officials are still resolving details of their strategy and how to communicate it to the public" however, "with interest rate increases on hold for now, planning for the bond portfolio could take center stage."

So with so much of the market attention once again falling on the the Fed's balance sheet especially in the aftermath Powell's recent dovish U-turn, there is a palpable expectation that tomorrow the Fed will announce it is nearing a decision on when to end the reduction of balance-sheet holdings, essentially a pause in the quantitative tightening cycle.

However, as Bloomberg's Vincent Cignarella warns, the difference in what the Fed says and what the markets hear may once again be on display during Wednesday's press conference. Indeed, the Fed has previously said the fed funds rate is the central bank’s primary monetary policy tool, not the balance sheet. As such, if the Fed holds to this mantra, investors looking for comments curtailing the balance sheet runoff may be "massively disappointed" according to the Bloomberg macro commentator.

He is not alone. In a note released by Bank of America overnight, the bank's strategist expect the Fed to deliver a message of patience on Wednesday, but they are "skeptical it will be as dovish as the market expects."

While the bank expects the Fed to remove the perceived calendar guidance of "further gradual increases" and replace it with more data-dependent language during tomorrow's meeting, which will not have an update of the Fed's Summary of Economic Projections (SEP), BofA does not expect Powell to make any formal announcements during his press conference on the balance sheet, "which risks disappointing some market participants."

At a minimum, Powell will reiterate his recent comments that the Fed is willing to be flexible with the balance sheet if it was seen as interfering with the normalization process or if economic conditions were to warrant an adjustment. He may also address the technical reasons for adjusting the path of balance-sheet normalization. Powell will have to balance how much additional detail to provide on the balance-sheet framework based on the progress of internal deliberations, however that's as far as he will go, and will stop well short of validating the WSJ story of an imminent halt in QT.

So how should markets adjust their expectations?

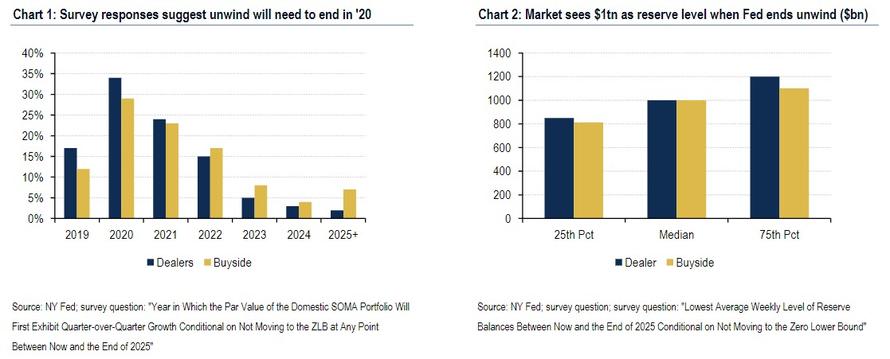

One of the first questions to address according to BofA is whether the Fed has embraced an "abundant reserve" regime (aka a floor system), which would imply a relatively large balance sheet vs the pre-crisis "scarce reserve" regime. Based on recent FOMC meeting minutes, Fed officials are leaning toward a floor system, and Powell may confirm this preference in his press conference, but note the Committee is still deliberating key balance-sheet details with the intention to provide more guidance at upcoming meetings. The market has already signaled to the Fed an expectation that it will need to maintain a relatively abundant reserve regime and that the unwind likely will not last beyond 2020 with around $1tn in reserves...

... which however is a problem as it suggest at least another $1 trillion, or a little under two more years of rolloff.

Where the market may be especially disappointed is in its expectations for additional detail on balance sheet (1) cessation conditions and thresholds and (2) composition in the longer run. A few thoughts from BofA on each:

- Cessation conditions and thresholds: the two conditions that could cause the balance-sheet unwind to end will be material (1) deterioration in economic conditions and (2) tightening in money or broader financial markets (i.e. the Powell Put). However, the thresholds for these considerations are uncertain.

- Longer run balance-sheet composition: the Fed has already suggested it prefers a portfolio of mainly Treasury securities (ie, not MBS) but has provided limited guidance on what this composition might look like. BofA expects the Fed will look to reduce the maturity of its Treasury portfolio to be in line with outstanding Treasury debt or to be similar to pre-crisis levels. Either way, the shortening of its UST holding tenor should favor a steeper UST and flatter spread curve all else equal.

The other key detail the market is looking for on the Fed's balance sheet is how the FOMC will ultimately transition to stopping the portfolio unwind. Specifically, the market would like to know if the Fed is going to taper its monthly reductions or stop cold turkey, a question that featured prominently in recently declassified deliberations from 2013 FOMC meetings. This question will likely depend on how willing the Fed is to stop the balance sheet early and take potential political criticism for being too accommodative to markets. If the Fed wanted to taper its reductions it would likely consider reducing the caps on its monthly redemption amounts for USTs and MBS or potentially just stop the UST portfolio reduction while allowing ongoing MBS redemptions. The Fed is likely to eventually lean toward this tapering approach since it is likely very uncertain as to the appropriate level of reserves in the banking system.

* * *

Besides providing details on the end of QT, one other place where the rates market may be disappointed is in just generally dovish the Fed would sound. One look at the latest Fed Funds shows that the rates market is widely expecting the FOMC to keep rates on hold at the January meeting and send dovish signals on both the outlook for rates as well as the balance sheet. However, BofA believes that the "Fed will be challenged to deliver a sufficiently dovish message to the market that risks a flatter curve and lower long-end rates."

While it is true that Fed policy maker communications have taken a decidedly dovish shift over the intermeeting period, most commentators doubt the Fed is yet ready to fully abandon its plans for further rate hikes later this year. If the Fed retains a soft hiking bias in the policy statement as discussed above, the market will likely need to assign higher odds to a Fed rate increase later in 1H19 beyond the current 5bp of hikes priced through July. These communications would also likely send long-end nominal and breakeven rates lower due to policy error concerns. Overall, the Fed is likely to retain some optionality to raise rates later in 2019, which risks sounding less dovish vs market expectations.

Going back to the balance sheet, BofA also believes that the Fed may disappoint market expectations here too. Based on the bank's reading of the December FOMC meeting minutes, the Fed likely has a number of important decisions it needs to make before it is willing to signal an imminent end of the balance sheet reduction. As such it is unlikely that the Fed is ready to adjust anything in writing around the balance sheet, which suggests no material language changes on the balance sheet in the FOMC statement, implementation note, or policy implementation plans and principles. This will likely disappoint those who interpreted the WSJ article as a signal from the Fed that the end of the balance-sheet unwind is rapidly approaching. As a result, BofA suspects that "risk assets may react negatively to the lack of balance-sheet guidance and contribute to a further flattening of the rates curve."

To summarize: the Fed will likely be challenged to deliver a sufficiently dovish message vs market expectations, which risks a sharply negative reaction in stocks, a flatter rates curve and a risk off USD reaction.

* * *

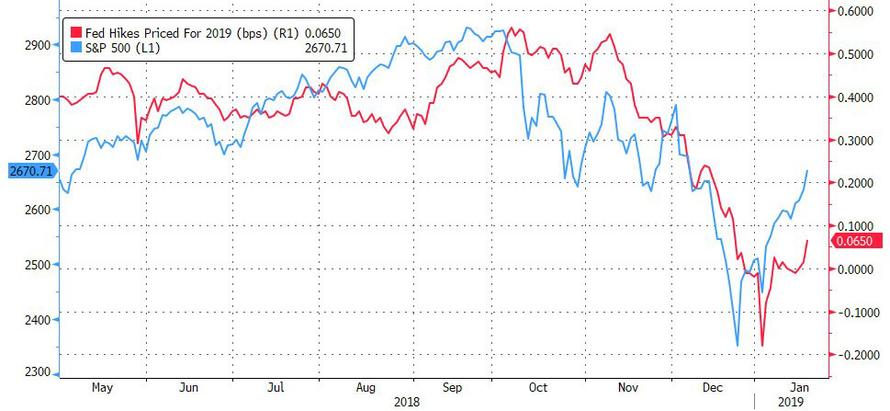

The above should make intuitive sense: after all, the Fed engages in either dovish jawboning or actual easing only when risk assets are sufficiently depressed to merit it, such as when the S&P was trading just above 2,300 after the "Mnuchin Massacre" last Christmas Eve. Now, with the S&P is 300 points higher, there is no need for any "emergency" intervention by the Fed, either verbal or otherwise.

And in keeping with the reflexive nature of the market which has rebounded sufficiently in recent weeks to push rate hike odds for 2019 back into the green, and away from an expected rate cut...

... Nomura's Charlie McElligott provides yet another reason why the Fed may disappoint markets tomorrow, and it has to do with the ongoing "standoff" between markets and monetary policy:

As the data stabilizes (which it is currently attempting now, with Citi U.S. Economic Surprise Index pivoting back “positive” to+1 from -25 on Jan 3rd) or even accelerates higher, we re-enter that "tighter financial conditions" negative feedback loop, as the Fed is ultimately forced back-into the picture;

Conversely, if the data were to again slow further from here, it confirms that “glass half-empty” current investor view that “the best is behind us” and that we have “overtightened ourselves into a slowdown”

Essentially, for the Fed to "get more dovish" at this point - which also includes potentially conceding on balance sheet tapering - it would require a major downdraft in U.S. economic data or another market volatility spasm—which is NOT something that is going to help the mood. BofA agrees with this, and notes that "a broader decline in risk assets could also cause the Fed to reconsider its balance-sheet plans, particularly if it believes that the balance sheet policy is a culprit for market stress."

Stated simply, for the Fed to be ready to announce a pause, or end, to Quantitative Tightening, stocks have to tumble once again, just so they can then be then rescued again by the Fed during the next sharp market drop.

The IMF Fears Political Rage Will Block Rescue By Fed In Next Crisis

The Trump administration might ask why it should “bail out” the Europeans who have been less than friendly to this White House. Here’s more…The International Monetary Fund has warned that the system of global cooperation that saved world finance in the 2008 crisis may break down if there is another major shock or a deep recession.

David Lipton, the IMF’s second-highest official, said it is unclear whether the US Federal Reserve would again be able to extend $1 trillion of dollar “swap lines” to fellow central banks — the critical measure that halted a dangerous chain-reaction after the collapse of Lehman Brothers and AIG.

“I fear that if at any time we have a worse than garden variety recession there will be anger and limitations in the way governments can respond,” he told a group at the World Economic Forum in Davos today.

“If there is a substantial crisis we may need central banks to act again in an extraordinary way. For the Fed this requires a fiscal backstop from the US Treasury, and at the beginning there may be some reluctance. I wonder whether they will be so willing to extend the swap lines,” Mr Lipton said.

It is a polite way of saying that the Trump administration might ask why it should “bail out” the Europeans who have been less than friendly to this White House, and why they should rescue the rest of the world. By the time the explosive consequences became clear it would be too late.

“So we have got to be very careful. There must not be unforced errors. We must ensure that the next recession when it comes is a garden variety,” said Mr Lipton, a leading figure in regulatory circles.

The lines are vitally needed because the world has built up $12.8 trillion of offshore dollar debt outside the Fed’s jurisdiction.

European, Japanese, and Canadian banks, among others, borrow on the capital markets at short-term maturities for worldwide lending in dollars. These markets can freeze up suddenly, as they discovered in October 2008.

Their own central banks are unable to print dollars and mostly have insufficient dollar reserves to provide emergency liquidity and stabilize the financial system in such circumstances. Only the Fed can act as the ultimate lender-of-last resort to the globalised dollar economy.

Mr Lipton said there was deep residual anger from the 2008 crisis. “People are hurt and they are less impressed than we that we did a clean-up afterwards,” he said.

He fears a nasty cocktail in the next downturn because much of the damage is likely to come from hidden leverage in asset management companies, with asset slumps hitting household wealth directly.

Mark Carney, the governor of the Bank of England, said at a separate Davos session that banks were now much safer than a decade ago, but risks of potentially systemic scale were building up elsewhere.

He raised a red flag over the money that has flooded into asset management, driven by a hunger for high yields after quantitative easing and low interest rates made it hard to generate returns.

The Achilles’ heel is the buildup of $30 trillion of assets held in funds, which are supposed to offer daily liquidity to investors but are invested heavily in underlying assets that not liquid. These assets are hard to sell “even in good times and very illiquid in bad times,” Mr Carney warned.

It is a classic example of borrowing short to invest long — the perennial cause of crises over the ages. There may also be further icebergs hidden from view. “Is there additional leverage in these entities that may add to the dynamics? That’s one of the big issues in global finance at the moment,” he said.

The Trade War Created A ‘Ticking Time Bomb’ For Texas Companies

Even though there’s been a so-called “cease-fire” by both nations, and tariffs aren’t going up, many companies in Texas are “ticking time bombs.”…

Many companies across the United States are reeling from the tariffs imposed by China and president Donald Trump during the ongoing trade war. Even though there’s been a so-called “cease-fire” by both nations and tariffs aren’t going up, many companies in Texas are “ticking time bombs.”

Layoffs at auto manufacturing plants such as Tesla, Ford, and GM are all having their impact on the economy. Thanks to the trade war, it’s become harder to make ends meet for businesses unless they raise their prices to cover the cost of the tariffs. Unfortunately, even though tariffs are stagnant for now, it’s an ever-increasing financial burden on many businesses in Texas.

According to Dallas News, a small business which relies on stone-coated steel roofing from China has been forced to take out high-interest loans to cover their costs. And that kind of pain lingers all over Texas as many companies face the choice of shouldering the now expected costs of the trade war or passing along the burden to consumersor seeking relief through an unforgiving bureaucracy or even confronting the sometimes impossible task of seeking new supply lines. Everyone seems surprised by this, and we hate to say we told you so, but we told you so. Americans will pay the cost for this trade war, and at a time when most families live paycheck to paycheck, it’s become a rather daunting and eerie overhanging concern.

While many Americans have all but forgotten the trade war, the backbone of the U.S. economy, small businesses, are still facing every single tariff. Not one of Trump’s tariffs has been removed, but the focus has been about the government shutdown instead.

To make matters worse, the trade deficit is now at record high levels; the reason Trump started the trade war was to lower said trade deficit. Trump has long claimed that the tariffs are all part of his plan to get better trade deals, correcting what he says has been a long history of other countries ripping off the U.S. and its workers. But the only thing ripping off the U.S. and its workers now, are the tariffs.

Tariffs Hurt the Heartland, a coalition of business and farm groups, has calculated that Texas companies have paid $1.1 billion in additional tariffs on products subject to Trump’s import levies through October, the most recent month with available data. “This is a ticking time bomb,” said Ralph Bradley of Jammy Inc., a Fort Worth auto-parts importer swamped by tariffs. “I don’t know why everybody is like, ‘Things are OK right now.’ They’re not. They’re bad as they’ve ever been, and they’re about to get worse.”

No comments:

Post a Comment