Financial Apocalypse: The Market Faces A $12

Trillion Day Of Reckoning

The day of reckoning approaches, and this

financial apocalypse might just crash the stock market, permanently. Here’s

why…Global markets are now facing a $12 trillion dollar

reckoning. The problem is staring the financial apocalypse right in the

face and has the potential to accelerate the coming stock market crash.

A recent report from the Congressional Budget Office has

warned that deficits will total $11.6 trillion, or 4.4% of gross domestic

product between 2020 and 2029. That’s far higher than the historical average of

2.9% over the past 50 years, according to data from INTL FCStone. This reckoning will come when no

one wants to buy that debt, and that time is quickly approaching.

According to Business Insider, a

deficit is only as ominous as the market’s inability to buy the excess debt

that’s issued along the way. INTL FCStone macro strategist Vincent Deluard has

serious concerns about that. So far, foreign central banks, and the U.S.’

central bank, The Federal Reserve. Central banks have begun selling debt

though, not taking on more. The Fed has slashed Treasury holdings by $260

billion since October 2017, their foreign counterparts have sold almost $1

trillion over the past four years. Deluard says that those debts will

terrifyingly be picked up by retail investors andpension funds.

But retail investors are running out of cash to by debt and

pensions could implode at any time. “If retail investors finance budget

deficits, the money will have to come from existing cash savings or equity

holdings,” Deluard said in a recent client note. “Reversing to the long-term

average stock allocation would free about $4 trillion in retail savings to go

into the Treasury market.”

Deluard sums

up the whole apocalyptic situation as one that has the potential to permanently

crash the stock market, as any negative pressure could push the economy to the

brink. “The investors which can replace the Federal Reserve and foreign

central banks as the marginal buyer of Treasuries are already fully invested,”

he said. “Equities will have to be sold.”

Not many are willing to understand the national debt and the deficit. But

those who do, are not optimistic.

Many Americans and the government find

themselves buried in debt they will likely never be able to repay. No one

knows exactly when this debt-based system will all come crashing down, but when

it does, it will be like nothing in mankind’s history. The

Fed Chair Just Admitted On Record That The US is Heading For a Debt Crisis

Yesterday, Fed Chair Jerome Powell made a starling admission,

“The U.S. federal government is on an unsustainable fiscal path,”Powell told the Senate Banking Committee, noting that “debt as a percentage of GDP is growing, and now growing sharply... And that is unsustainable by definition.”

Source: Yahoo! Finance

What Powell said has been obvious to anyone with a functioning brain for years. However, we have to remember one key item…

This is the FED CHAIR talking… the person in charge of maintaining STABILITY for the financial system and who controls the printing the of the US currency… not just some talking head on TV.

So just how bad are the US’s finances that the Fed Chair would be willing to admit this PUBLICLY?

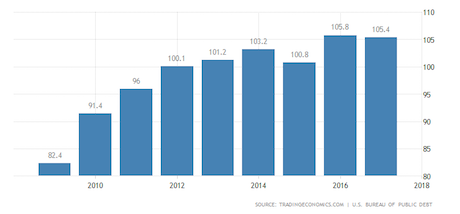

Total US debt has just hit $22 trillion. The US now has a Debt to GDP ratio of 105%. This is roghly where Greece was when it entered a debt crisis in 2010 (though there are certain key differences between the US's and Greece's abilities to deal with their debt issues).

Fed Chair Jerome Powell has also made it clear that it is NOT the Fed’s job to fix this.

“We need to stabilize debt to GDP. The timing the doing that, the ways of doing it —through revenue, through spending — all of those things are not for the Fed to decide.”

Source: Yahoo! Finance

So… either the US Political Elite needs to spend less (not going to happen)or it needs to find access to new sources of capital… ours.

With that in mind, the current political agenda to push for Wealth Taxes, cash grabs and other means of raising capital all makes sense.

Consider the following:

- The IMF has already called for a wealth tax of 10% on NET WEALTH.

- More than one Presidential candidate for the 2020 US Presidential Race has already openly called for a wealth tax in the US.

- Polls suggest that the majorityof Americans support a wealth tax.

And if you think this will stop with the super wealthy, you’re mistaken. You could tax 100% of the wealth of the top 1% and it would finance the US deficit for less than six months.

Which means…

Cash grabs, wealth taxes, and more will soon be coming to Main Street America.

Indeed, we've uncovered a secret document outlining how the Fed plans to both seize and STEAL savings during the next crisis/ recession.

We detail this paper and outlinethree investment strategies you can implement right now to protect your capital from the Fed's sinister plan in our Special Report The Great Global Wealth Grab.

The Doomsday Scenario For The Stock And Housing Bubbles..It was always folly to believe that inflating asset bubbles could solve the structural problems of a post-industrial economy.

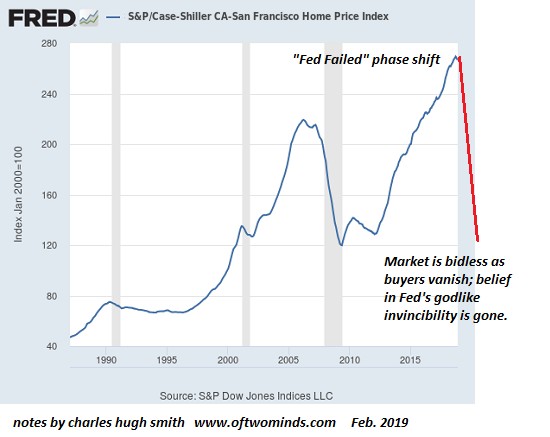

The Doomsday Scenario for the stock and housing bubbles is simple: the Fed's magic fails. When dropping interest rates to zero and flooding the financial sector with loose money fail to ignite the economy and reflate the deflating bubbles, punters will realize the Fed's magic only worked the first three times: three bubbles and the game is over.

So what happens when punters realize there won't be a fourth bubble? They sell. Bids disappear because who's dumb enough to bet (with Japan and Europe as lessons) that more liquidity and negative interest rates will magically work when zero interest rates didn't move the needle?

Who's foolish enough to catch the falling knife (i.e. buying plummeting assets on the way down) on the unsupported assumption that the next dose of Fed magic will reverse a bidless market?

And should the Fed start buying stocks, mortgages, housing and bonds to prop up those bidless markets, what's the message it will be sending? Desperation.If the only buyer is the money-printing central bank, that's pretty good evidence that your economy and markets are in free-fall.

The loss of faith in central bank magic will be gradual at first, as magical thinking dies hard. It's oh so comforting to believe the central bank will rescue every overleveraged mal-investment and bail out every high-risk speculation, but the funny thing about the Fed's magic is it only works in liquidity crises--in every other condition, it only makes matters worse.

Does making it cheap to borrow improve the productivity of capital investments? You must be joking. The poster child of Fed magic is corporate buybacks, which 1) create no goods 2) create no services 3) do nothing to improve real wealth creation, i.e. higher productivity and 4) burden the company with higher debt loads, inhibiting future capital investment in actual productive capacity.

The only thing stock buybacks accomplish is to enrich shareholders and top managers with stock options. Rather than fix what's broken in the economy, the Fed's plan of "make the already-wealthy even wealthier" has created a new and monstrous problem: soaring wealth inequality.

The Fed's idea of a solution was to triple the value of a small bungalow from $150,000 in the late 90s to $450,000 in 2007. When that bubble burst, the Fed's solution was to double the bungalow's value to $900,000 today.

The structural problems of the U.S. economy cannot be solved by inflating asset bubbles, but that's all the Fed can do. Ironically, everyone cheering on Fed dovishness today is writing the obituary of Fed influence going forward because the masses have awakening to the Fed's role and the political blowback against enriching the already-rich is going to blow away the Fed's political leeway to further enrich the already-rich.

Since the Fed has lost the political permission to further increase wealth inequality, it won't be able to inflate another asset bubble. But even if the Fed was able to bamboozle the populace into allowing it to inflate another asset bubble, the mechanisms no longer have the desired effect: what worked to inflate the prior three bubbles no longer has the power to inflate a fourth bubble.

Those who are confident that there's nothing standing in the way of a fourth asset bubble need to back up their faith with some historical examples of bubble economies running past the third bubble.

This will lead to a sudden realization that the Fed has failed and can't possibly succeed in inflating a fourth asset bubble. This will unleash a phase shift in the market's belief system that will lead to a conclusion that the only rational strategy is to sell now before the bid disappears entirely.

But by then, of course, it's too late, because everyone else will be hitting the "sell" button at the same time.

It was always folly to believe that inflating asset bubbles could solve the structural problems of a post-industrial economy in the throes of profound demographic and technological change. The Fed has pursued the folly for 25 long years to the cheers of the class that has seen their wealth soar but reality is about to play Godzilla to the Fed's Bambi.

This is the Doomsday Scenario for those who believed $900,000 bungalows were going to $1.8 million and the S&P 500 was going from 2,800 to 5,600., but for those who understand the mortal danger of relying on asset bubbles to prop up a failing status quo, it will be a welcome reset that will enable desperately needed structural changes.

No comments:

Post a Comment