World stocks inched up and the dollar steadied on Wednesday after Apple failed to disappoint investors and reported earnings, meeting Wall Street's lowered expectations, and sending its stock higher in a muted session as investors braced for a barrage of catalysts, from US-China trade talks and the Fed meeting to an avalanche of corporate earnings. The pound halted a two-day decline and U.K. shares rallied after lawmakers voted to renegotiate Brexit.

The MSCI world equity index was fractionally in the green following gains in Asia overnight and a muted start to trading in Europe. The pan-European STOXX 600 benchmark index was flat.

US equity futures all rose, supported by with Apple shares which extending gains in pre-market trading after first-quarter earnings reassured investors that the worst may be past, although it remains very much unclear if Apple can pivot from a cell phone to a "services" company, especially with services revenue growth slowing sharply. In any case, investors were relieved that there was no more bad news after the company shocked financial markets at the start of this month with a revenue warning that sparked fears that U.S.-China trade tensions were taking a toll on the tech sector.

“Apple earnings delivered enough for investors to come back on board,” said Markets.com analyst Neil Wilson. “Although Apple still faces big questions like pricing structure, upgrade cycles, FX headwinds and weaker Chinese demand, we did get a positive answer to the key question on whether services margins can help rerate the stock higher.”

The Stoxx Europe 600 Index was mixed after data showing euro-area economic confidence extended its worst losing streak in a decade, ahead of Sino-U.S. trade talks and a closely watched Fed announcement in which Chair Powell is likely to disappoint markets. The UK's FTSE 100 traded higher by 0.9%, climbing for a second day and outperforming continental bourses, with CAC also rising 0.5%; DAX trades lower by 0.4%. Investors fretted about the possibility of a “no-deal” British departure from the European Union after UK lawmakers instructed Prime Minister Theresa May on Tuesday to reopen the treaty she had negotiated with Brussels to replace a controversial Irish border arrangement.

Goldman Sachs upped its “no-deal” Brexit probability to 15 percent from 10 percent, and cut the chance of Brexit not happening at all to 35 percent from 40 percent according to Reuters. “Tuesday’s Brexit amendments offered little additional clarity to anyone,” Goldman Sachs analysts wrote.

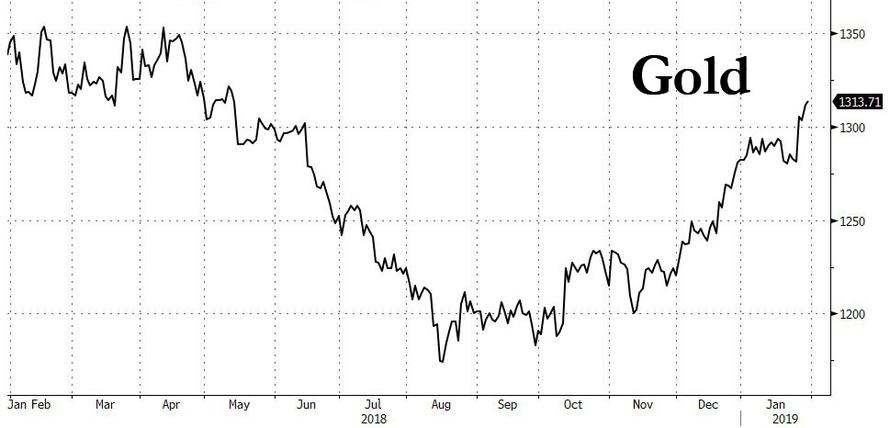

Earlier in the session, Stocks in Japan and China slid, while they increased in South Korea, Australia and Hong Kong. The yuan advanced to the highest since July on hopes for the U.S.-China trade talks getting underway in Washington. Growing fears that central banks are preparing to reflate "whatever it takes", helped send gold to an eight-month high, underscoring lingering investor caution.

While Apple CEO Tim Cook said trade tensions between the United States and China were easing, lifting the mood before another round of official talks on Wednesday in Washington, that may prove another unreasonably optimistic take. The two sides are meeting next door to the White House in the highest-level talks since U.S. President Donald Trump and his Chinese counterpart Xi Jinping agreed a 90-day truce in their trade war in December.

“I expect that the Washington summit will help pave the way for an extension of the trade truce. This is also what markets expect and a failure of the talks is not priced in at all,” said Giuseppe Sersale, fund manager at Anthilia Capital. Which is also why the risk of downside following the trade talks is far greater.

Elsewhere, following lackluster corporate earnings in January, all eyes will be on tech giants including Facebook and Microsoft when they report today. That will be the backdrop for the Fed’s policy decision and its assessment of the U.S. economy, while the arrival of Chinese negotiators in Washington for talks to resolve the ongoing trade dispute adds another layer of complexity.

Expectations from Wednesday’s Federal Reserve rates review are that policymakers will reinforce their recent dovish stance, given signs of a slowdown in the U.S. economy. “We believe the Fed is likely to show the flexibility markets are seeking at its upcoming meeting, as it balances still solid domestic economic growth against slower global growth and less significant, but persistent, domestic risks,” said John Lynch, Chief Investment Strategist at LPL Financial.

And yet nobody really has any clue what happens next: “Such is the extent of uncertainty across global markets at the moment that investor sentiment is struggling to gain any meaningful traction,” Simon Ballard, a macro strategist at First Abu Dhabi Bank, said in a note. “The overarching veil of caution suggests that near-term positive momentum potential will likely remain limited. It is still very much global trade and the global rates outlook that sit at the heart of investor focus.”

European bond markets little changed across core and periphery, trading in tight ranges, as are USTs. BTPs shrug off talk of early Italian election, with 5-and 10-year auction well-received. Bloomberg USD index also steady, with Aussie dollar leading G-10 gainers, followed by the pound. Swedish krona edges lower after soft consumer confidence data. In commodities, WTI and Brent both up ~0.3%, metals trading higher across the board

In FX, the Bloomberg Dollar Spot Index was confined to a narrow range as investors look ahead to the Federal Reserve policy decision and U.S.-China trade talks. The pound climbed above $1.31 as bias remained to fade dips, while the Aussie led gains versus its G-10 peers as inflation data beat forecasts. Emerging-market currencies climbed to a fresh seven-month high: the Australian dollar surged 0.5 percent as inflation topped forecasts, while the Chinese yuan reached a six-month high in the offshore market before the trade talks. Elsewhere, the Mexican peso declined as Fitch Ratings cut the debt of state oil company PEMEX to one notch above junk.

Iron ore surged after Brazil’s Vale SA, the world’s largest producer, outlined plans to cut output after a deadly dam breach. Iron ore is now up nearly 30% since November.

WTI crude gained as traders assessed the impact of U.S. sanctions against Venezuela, a major exporter. Brent (+0.6%) and WTI (+0.7%) prices are firmer as the complex reacts to the smaller than expected build in yesterday’s API Crude Stocks alongside reports that Saudi Arabia are planning on further oil production cuts and exports next month; additionally, believing that SPR releases are a solution to the US’s Venezuela oil shortage problem. Follows sanctions announced on Monday which aim to stop the proceeds from PDVSA’s crude exports of around 500,00 BPD to the US.

In addition to the above, expected data include mortgage applications and pending home sales. Alibaba, AT&T, ADP, Boeing, McDonald’s, Microsoft, Nasdaq, Facebook, Mondelez, Qualcomm and Visa are among the slew of companies reporting earnings

Market Snapshot

- S&P 500 futures up 0.2% to 2,645.50

- STOXX Europe 600 up 0.08% to 357.51

- MXAP up 0.1% to 154.52

- MXAPJ up 0.4% to 504.93

- Nikkei down 0.5% to 20,556.54

- Topix down 0.4% to 1,550.76

- Hang Seng Index up 0.4% to 27,642.85

- Shanghai Composite down 0.7% to 2,575.58

- Sensex down 0.06% to 35,570.42

- Australia S&P/ASX 200 up 0.2% to 5,886.70

- Kospi up 1.1% to 2,206.20

- German 10Y yield fell 0.2 bps to 0.198%

- Euro down 0.04% to $1.1428

- Italian 10Y yield fell 3.1 bps to 2.277%

- Spanish 10Y yield rose 1.6 bps to 1.254%

- Brent futures up 0.6% to $61.68/bbl

- Gold spot up 0.1% to $1,313.36

- U.S. Dollar Index little changed at 95.78

Top Overnight News from Bloomberg

- U.K. PM Theresa May promised to renegotiate the most contentious part of her Brexit deal after it was rejected by Parliament. She will now head to Brussels with the threat of economic chaos still looming over her country; The Irish government rejected any softening of the so-called backstop

- Despite the best efforts of central bankers, investors are betting the next phase of European monetary policy will look a lot like the last one; market expectations for the peak rate in this cycle are being slashed, and the implied timing for a first hike since 2011 is being pushed out further by the day

- Iron ore markets were convulsed after Brazil’s Vale outlined plans to cut output after a deadly dam breach. Prices surged, with futures rallying more than 9%

- Italian Deputy Prime Minister Matteo Salvini is facing pressure to force an early election this year from lieutenants frustrated by dealing with an unruly coalition partner

- Jerome Powell will debut the Fed’s latest communications strategy -- a press conference eight times a year -- by emphasizing patience in raising interest rates, a message the chairman struggled to deliver in December

- From Hong Kong to Japan, exports data for December showed a marked downturn as supply-chain disruptions triggered by U.S.-China tensions and a cyclical slowdown in the world economy, led by China, hit the trade-reliant region

- Brexit will probably split BOE policy makers on how to respond

- U.S. and China are sitting down Wednesday for the first of two days of talks aimed at finding a solution to a trade war. Administration officials and other people familiar with the state of play say the two sides remain far apart

- Several senior members of Matteo Salvini’s League are urging him to capitalize on a growing lead in opinion polls to ditch the anti-establishment Five Star Movement

- A lack of clarity surrounding the U.K.’s departure from the EU pushed confidence among British employers this month to levels last seen in the wake of the Brexit vote

- Average daily foreign-exchange turnover in the U.K. dropped to $2.6t in October 2018, a 4% fall from the record high of $2.7t in April 2018, according to Bank of England data. In North America, daily volume dropped 0.1% to $995b

Asian stocks traded indecisively with the region tentative heading into this week’s key risk events and as participants also digested better than expected Apple results, which only provided brief support to US equity futures after-hours. ASX 200 (+0.1%) and Nikkei 225 (-0.4%) were both subdued although strength across commodities just about kept the Australian benchmark afloat, while Tokyo stocks were weighed by currency effects and uninspiring corporate updates. Elsewhere, Hang Seng (-0.1%) and Shanghai Comp. (-0.3%) declined at the open amid broad weakness in the region and with China Life Insurance shares heavily pressured after it flagged a 50%-70% drop in FY net, although Chinese markets then rebounded off lows amid a non-committal tone ahead of the looming US-China trade talks and after the PBoC injected liquidity for the 1st time in 8 days. Finally, 10yr JGBs were uneventful with prices stuck to within this week’s tight range amid the indecision seen across the region and with an unchanged BoJ Rinban announcement largely ignored.

Top Asian News

- Chinese Firms Slash Profit Forecasts, Fueling Slowdown Fears

- JPMorgan Names Filippo Gori as Deputy CEO for Asia Pacific

- Malaysia Lets Goldman Decide How Much of $7.5b Bank Wants to Pay

- Hong Kong Dollar Spikes as Pre-Holiday Liquidity Tightness Seen

- Calm Has Descended on Asian Stocks Ahead of Fed, Trade Talks

Major European equities have been indecisive [Euro Stoxx 50 U/C] taking lead from the indecisive trade seen overnight ahead of today’s FOMC rate decision and press conference. Benefitting from sterling effects the FTSE 100 (+1.2%) is the outperforming index, with Burberry (+2.5%) in the green in sympathy with LVMH (+6.3%) after their earnings; and stating they are cautiously confident regarding 2019. Other luxury names such as Kering (+3.4%), Christian Dior (+4.0%) and Pandora (+2.0%) are also up in sympathy with LVMH. Sectors are mixed with outperformance in consumer discretionaries and some underperformance in telecom names. Other notable movers include Atos (+8.1%) who, following their earnings and 2019 guidance confirmation, are at the top of the Stoxx 600. Elsewhere, Novartis (-1.2%) are down following results, where the Co. missed on Q4 sales and operating income, as are Siemens (-1.5%) after their Q1 revenue came in just under expectations; Co. also stating they have made no further concessions on the Alstom (-0.5%) merger and will not pursue it at all costs.

Top European News

- Siemens CEO Fires Broadside Against EU With Rail Deal on Brink

- Atos to Hand Out Worldline Shares, Paving Way for More Deals

- Santander Seeks to Move Past Orcel Fiasco With New Plan

- U.K. Lending Slows as Brexit Uncertainty Hangs Over Outlook

- Why Irish Reckon May Still Boxed In on the Brexit Backstop

In FX, the DXY index and Greenback overall looking to the Fed for more direction, as the DXY meanders between 95.875-682.

- AUD - Firmer than expected Australian Q4 CPI data has helped to revive a flagging Aud/Usd, with the pair back up on the 0.7200 handle and close to daily chart resistance around 0.7207, while Aud/Nzd has rebounded firmly over 1.0500, as the Kiwi continues to meet offers around 0.6850 vs the Usd.

- GBP - The next best G10 currency, as initial post-UK Parliamentary Brexit vote downside is reversed to an extent in Cable and Eur/Gbp, with the former reclaiming 1.3100+ status and perhaps deriving some respite from a bounce ahead of the 200 DMA (circa 1.3055). Meanwhile, the cross has recoiled relatively sharply from fresh peaks just shy of 0.8760 towards 0.8715, and perhaps the bulk of noted month end buying interest has now been transacted.

- CAD - Another major ‘outperformer’, or at least holding a firmer line vs its US counterpart within a 1.3235-85 range, and still cushioned by the recuperation in crude prices. Ahead, perhaps a little independent impetus via Canadian average weekly earnings data, but in truth this pales against the sheer volume of US releases on tap, and of course the impending FOMC.

- JPY/EUR - Both flat to a tad softer vs the Dollar, and very confined in the run up to the Fed, as Usd/Jpy continues oscillate between 109.00-50 amidst undulations in broad risk sentiment, and the single currency remains entrenched in a 1.1400-50 band (with the topside also ‘protected’ by the 200 DMA around 1.1444).

- CHF/SEK - The Franc and Krona have extended recent losses/underperformance/retracements, with the Chf perhaps undermined by weaker than forecast Swiss KoF and ZEW sentiment surveys, while the Sek will not have been helped by declines in consumer and industrial confidence that will merely keep the Riksbank on the back-burner. Usd/Chf is hovering above 0.9950 and Eur/Sek just below 10.3900.

In commodities, Brent (+0.6%) and WTI (+0.7%) prices are firmer as the complex reacts to the smaller than expected build in yesterday’s API Crude Stocks alongside reports that Saudi Arabia are planning on further oil production cuts and exports next month; additionally, believing that SPR releases are a solution to the US’s Venezuela oil shortage problem. Follows sanctions announced on Monday which aim to stop the proceeds from PDVSA’s crude exports of around 500,00 BPD to the US. Gold (+0.1%) is trading in the middle of its USD 6/oz range, on a steady dollar ahead of today’s FOMC decision. Elsewhere, Vale’s CEO announced they will take up to 10% of the Co’s output offline to decommission 10 dams following Friday’s dam burst.

Looking at today’s calendar, today's Fed meeting outcome will no doubt hog much of limelight while the data highlights in the US this afternoon include the January ADP employment change report (183k expected) and December pending home sales (+0.5% mom expected). In Europe this morning we’re kicking off with the December import price index reading in Germany followed by December consumer spending data in France, December money and credit aggregates data in the UK and then January confidence indicators for the Euro Area. Today is also the day that trade talks are due to resume between the US and China with Vice Premier Liu Ge meeting with US Trade Representative Lighthizer and Treasury Secretary Mnuchin in Washington. Finally, it’s a busy day for earnings with reports due from Microsoft, Facebook, Alibaba, Visa, AT&T, Novartis, Boeing and McDonald’s.

US Event Calendar

- 7am: MBA Mortgage Applications, prior -2.7%

- 8:15am: ADP Employment Change, est. 181,000, prior 271,000

- 10am: Pending Home Sales MoM, est. 0.5%, prior -0.7%; YoY, est. -7.0%, prior -7.7%

- 2pm: FOMC Rate Decision

- U.S. BEA Working With Census, OMB on Economic-Data Schedule

DB's Jim Reid concludes the overnight wrap

Morning from Dublin where there will be lots of eyebrows raised this morning after the events in U.K. parliament last night. However if you think Brexit negotiations are currently in a deep freeze then spare a thought for those in the Midwest of the US today who will face a once in a generation polar vortex which will bring temperatures down to -53C (-64F). Chicago will be even colder than Antarctica and see lows of -27F, with a wind chill factor making that feel closer to -50F. Good luck to all our readers there. Rather worryingly Chicago police say people are being robbed at gunpoint of their coats and those hideously expensive Canada Goose jackets that were two a penny in Davos last week have been especially targeted. The good news is that if you’ve been desperate to pick up a ticket to Hamilton they are reselling at half-price for tonight in Chicago as no-one wants to brave the elements. So for those that don’t mind the cold there’s your opportunity. Don’t wear your Canada Goose jacket out though.

One area where there was a thawing out last night was that U.K. Parliament now have a mandate for a Brexit deal. The problem is that this mandate has already been ruled out by the EU. Nevertheless Brussels have been asking the U.K. what they want for the last two and a half years and finally we have an outline of what they want. Parliament now seems happy to vote for the withdrawal agreement as long as the Irish backstop is removed/amended in a satisfactory manner.

To recap in as brief a way as possible as everyone might be bored by now, the only amendments that passed were a non-binding one (Spelman) that voted against leaving with no-deal and one (Brady) that asked the government to renegotiate the withdrawal agreement to accommodate an alternative arrangement to the Irish backstop. So Mrs May will go to Brussels and try to reopen negotiations on an agreement that the EU have already said before and after last night’s votes that they won’t reopen. Whether diplomacy can work in the background remains to be seen.

All the reaction I’ve seen from the market overnight talks about it in terms of it being a unicorn-like mission with absolutely no chance of success. However stranger things have happened. Maybe I’m being naive but both the EU and the U.K. don’t want there to be a no-deal and both parties are categoric that there can’t be a hard border in Ireland. To me there is scope for negotiations on that basis. However I haven’t heard anyone that agrees with me yet. Indeed DB’s Oli Harvey downgraded Sterling to neutral overnight and overall thinks developments have on balance become more negative. His updated probabilities are; 1) May pivots to a softer Brexit stance via the Political Declaration on the Future Relationship: 15% (previously 40%), 2) Last-minute ratification on the existing deal in the face of no alternatives 50% (previously 30%), 3) Second referendum: 5% (previously 15%), 4) New election: 15% (previously 10%), 5) No deal Brexit: 15% (previously 5%). See the full report here . In market terms Sterling dropped as various soft or delayed Brexit motions failed to pass and closed -0.74% at $1.3066. Overnight in Asia the Pound has consolidated around those levels and as we go to print it’s at $1.3086.

Moving on, we’re now firmly into the business end of the week with the next event for markets to navigate being the first Fed meeting of 2019 tonight. With neither the consensus nor the market pricing in any chance of a hike, most observers will instead be watching to see if the current narrative is maintained. Our US economists expect the most meaningful alteration to the post-meeting statement to be to the forward guidance language. Indeed at the December meeting the statement noted that the “Committee judges that some further gradual increases” in rates would be consistent with the Fed’s dual mandate. Our team believe that this statement is now too strong given intermeeting developments and expect the language to be softened by noting that the Fed expect “further gradual adjustments” in policy will be consistent with the Fed’s objectives. As for Powell’s press conference, our colleagues expect a similar message to be reiterated with the unspoken takeaway likely to be that June is the earliest possible date for another rate increase. The balance sheet topic is likely to be a talking point although our team don’t expect any major announcements.

As you’ll see in the day ahead at the end, we’ve also got a bumper day for earnings scheduled, especially in the tech sector, while trade talks between the US and China also formally get underway again today. Yesterday, in an interview with Fox, Treasury Secretary Mnuchin confirmed that “everything is on the table” in response to a question about Trump potentially dropping all tariffs in return for a good deal. For what it’s worth yesterday our China Chief Economist Zhiwei Zhang published a short update in which he concluded that he expects the two governments to reach a partial trade deal by March 1st, with China making concessions to buy US goods, lower tariffs, and open part of the service sector. Zhiwei believes that the US may stop imposing more tariffs in exchange. That all said, he also expects the Huawei case to extend beyond March.

Back to markets, where despite Mnuchin’s comments, corporate earnings and the tech sector spoilt hopes of a bounce back for US equities with the NASDAQ (-0.81%) at the forefront of declines along with the NYSE FANG index (-2.09%) which plummeted for its fifth daily decline in the last seven sessions. After the bell, however, Apple beat earnings expectations and sparked a rally, with shares up +5.9% in post-market trading. This helped NASDAQ futures retrace most of their declines from yesterday, with front-month contracts up +0.66% overnight. Digging into the results, Apple beat on headline earnings, with EPS at $4.18 versus consensus $4.17, and also on revenue, at $84.3bn versus estimates for $83.9. Notably, revenue fell especially hard in China ($13.2bn from $17.9bn last year), as signaled in the company’s earlier guidance.

Prior to this the S&P 500 closed down -0.15% while the DOW (+0.21%) just about managed to stay onside thanks to some positive large-cap earnings. Better than expected results from 3M (+1.94%) and Pfizer (+3.16%) seemingly helped offset some of the post-Caterpillar global growth concerns however at the other end Allergan (-8.60%) and Harley-Davidson (-5.08%) succumbed to heavy falls after their respective results failed to convince the market. Anecdotally, companies’ guidance is mixed on the macro outlook, with Whirlpool CFO Peters saying “continued economic and trade uncertainty to temper overall demand” while Verizon CFO Ellis anticipates “no major impact at this point on the macro economy or even the shutdown”.

Earlier in Europe, the STOXX 600 gained +0.80% while treasuries and bunds traded close to flat. BTP yields rallied -3.1bps to a new 6-month low. The energy sector outperformed, gaining +0.32% in the US and +1.30% in Europe, as Brent crude oil prices rose +2.32% to mostly retrace Monday’s selloff. The move was driven by comments by Saudi Arabia’s Energy Minister Al-Falih, who said that he expects to cut oil output further next month and to keep production “well below” the levels agreed by OPEC. New US sanctions on Venezuela’s national oil company also helped ease the supply outlook, while historically cold weather in the US increases demand for heating oil.

Markets in Asia are also trading slightly cautiously overnight with the Nikkei down -0.32% and bourses in China flat as markets await the start of trade talks. The Hang Seng (+0.27%) and Kospi (+0.27%) have however posted modest gains while EM FX is similarly mixed.

In other news, the latest sentiment indicator in the US took on added focus yesterday in light of uncertainty around government policy and recent financial market volatility. Indeed the January consumer confidence reading slumped even more than expected, to 120.2 (vs. 124.0 expected) from a downwardly revised 126.6 in December. The present situations index was broadly flat at 169.6 however the expectations component fell to 87.3 and the lowest since 2016 likely reflecting the government shutdown. There were lots of people on twitter suggesting that the ratio between the two suggests an imminent recession based on historical observations. However if the disparity mostly reflects the shutdown it could easily reverse and nullify the signal. The graph between the two does look worrying though. On the plus side the ratio of respondents describing jobs as “plentiful” versus respondents saying they are “hard to get” reached a new cyclical high, which points to further labour market strength.

Meanwhile the S&P CoreLogic house price index confirmed that prices rose +4.68% yoy in the 20 biggest cities in November and therefore slowing slightly from October. In Europe we only had the French consumer confidence print for January which surprised to the upside at 91 (vs. 88 expected and 86 in December). That marks a decent correction from the protest’s impacted December reading and is in stark contrast to the PMIs in France that we saw last week.

Looking at today’s calendar, this evening’s Fed meeting outcome will no doubt hog much of limelight while the data highlights in the US this afternoon include the January ADP employment change report (183k expected) and December pending home sales (+0.5% mom expected). In Europe this morning we’re kicking off with the December import price index reading in Germany followed by December consumer spending data in France, December money and credit aggregates data in the UK and then January confidence indicators for the Euro Area. Today is also the day that trade talks are due to resume between the US and China with Vice Premier Liu Ge meeting with US Trade Representative Lighthizer and Treasury Secretary Mnuchin in Washington. Finally, it’s a busy day for earnings with reports due from Microsoft, Facebook, Alibaba, Visa, AT&T, Novartis, Boeing and McDonald’s.

No comments:

Post a Comment