QUESTION:

Mr. Armstrong; I have been reading your blog for years now. It is obvious that you are well connected behind the curtain. It did not take but perhaps a day or two after you explain the difference between wealth and income to suddenly see Elizabeth Warren adopting the position to impose a wealth tax of two percent on people with assets of 50 million or more. Will this not cause the rich to leave as they did in France?Thank you for the enlightenmentHT

ANSWER:

Warren’s proposal is not only going to be the final nail in the coffin of capitalism and the United States but indeed, investors will migrate to China. The danger is clear...

The famous legal case that led to the Supreme Court’s Right to Privacy was Griswold v Connecticut. It involved a doctor who was criminally convicted for giving married persons information and medical advice on how to prevent conception with a condom. The religious extremist took the view that the Bible said go forth and propagate and thus they imposed their religious beliefs upon the majority by criminal law. The Supreme Court correctly created the Right to Privacy out of a simple logical conclusion. How would the state outlaw the use of a condom in marriage? How could it be enforced? Would a state policeman have to inspect before you had intercourse? Would you then have to apply for a license to have intercourse so the state would then know to send the policeman into your bedroom?

In order to impose a Wealth Tax, that means the absolutely EVERYONE would then by law be compelled to list everything they own right down to your wedding rings so the state could them calculate your wealth to impose a tax.

This type of tax would absolutely destroy the Right to Privacy.

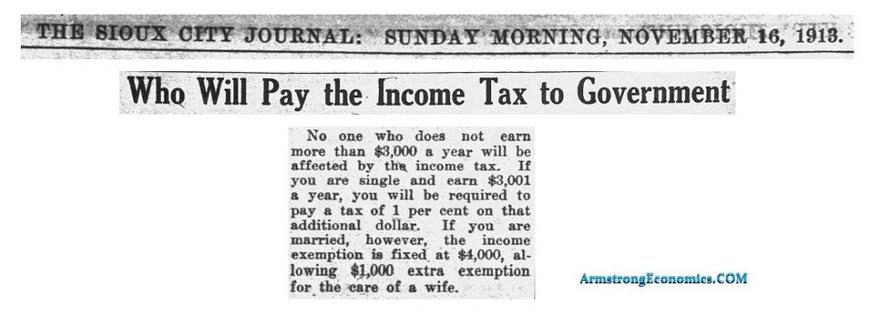

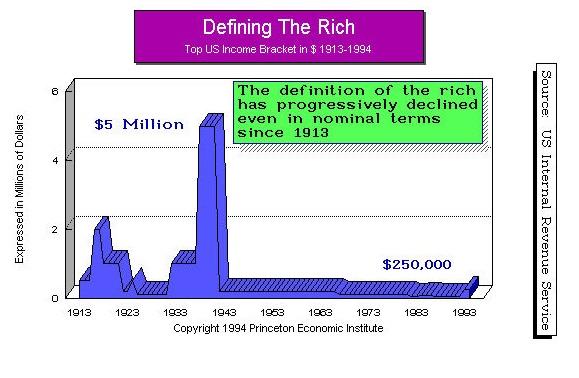

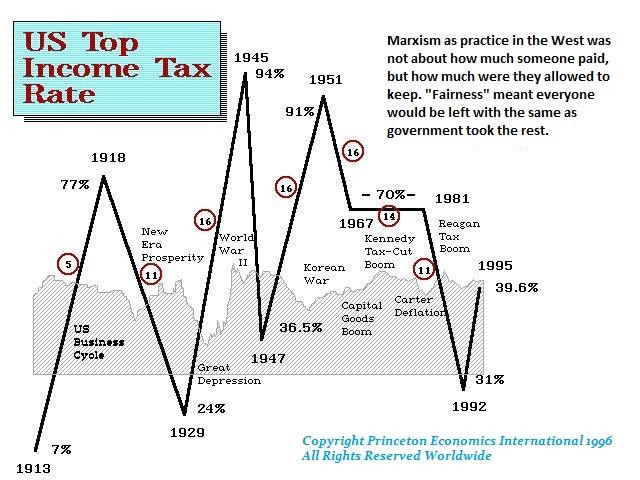

Putting the Right to Privacy aside, the government can NEVER be held to whatever it promises today. The government will always introduce a tax and claim it will only apply to the “super-rich” as she is doing – $50 million will pay 2% annually on the value government claims your assets are worth and $1 billion+ will pay 3% annually. At 8%, you will confiscate all of a person’s assets in less than 10 years. Elizabeth Warren is the new Karl Marx advocating communism in slow motion. To sell the income tax in 1913, it was to be just 1% and only on the rich. Ever since it rose to 94% and now the Democrats want to raise it to 70%. No matter what rate they say today, they will always change it.

Those below that $50 million thresholds will cheer – go get em. They did precisely that in 1913. To sell the introduction of the income tax, they drew the line at $3,000 when a good job paid $0.30 per hour or $18 a week which was just under $1,000 a year. So to get a new tax in, they will ALWAYS place it above the majority of people and pretend they will never be impacted. This is the luxury tax I saw in Australia pitching they would tax their Ferraris, Fur Coats & French Wines. They cheered. When the tax was imposed, it included all electrical products.

Once they create a new tax under false promises, they ALWAYS change the specifics. Just as ONLYthe rich would pay income tax, then comes Roosevelt’s New Deal and morally the same claims were made but suddenly they introduce the Payroll Tax and not everyone pays income tax. They will do the very same thing with a Wealth Tax. You cannot hold the government to whatever it promises. They will constantly change the rates and to whom it applies based upon they need money. They have constantly changed the DEFINITION of the “rich” and now it begins at $500,000. As the pension crisis explodes, they will need money for their own pensions like California, Illinois, and New Jersey, just to name a few. They will drop the Wealth Tax to the same level of income tax. Regardless, EVERYONEwill have to report their total wealth in order to make sure you are paying your Wealth Tax.

Once any new form of taxation is introduced, then politicians will ALWAYSraise the rates and lower thresholds as they continually need a never-ending source of other people’s money. The $50 million thresholds will crash to normal levels and the criteria will change for everyone. Every person will have to report their entire wealth right down to inheritance or else the government will be unable to confirm you are under the $50 million entry level. There are a lot of “super-rich” kids who inherited companies rather than cash. If your father’s company was worth $1 billion, how do you get $30 million in cash to pay taxes without liquidating at least part of the company? Then you have to pay that EVERY year!

Warren’s tax will cause a collapse in investment which means that unemployment will only rise. When people appear to make a fortune because their company goes public, they have restrictions that prevent them from selling for a period. A wealth tax will be applied simply based upon values of shares they cannot sell. This would certainly lead to a mass exit of the upper-class the very same as what took place in France – they just left!

Like the income tax, Warren’s Wealth Tax will move to 100% application to everyone because of some new event or war. Since we are already in a collapsing state of socialism, they will argue to raise this new Wealth Tax to save government pensions. Effectively, we will have a NATIONAL property tax that will include your home and then you will have to pay income tax on top of that. The pension funds will become a national emergency and the shift to increasing taxes will take place exactly as we are witnessing in California – if it moves, tax it; it fails to move tax it; and if it has any use whatsoever (like water) tax it.

Back in the ’90s, I was working to trying to Privatize Social Security to invest in equities rather than 100% government bonds and reform taxes by moving to a national retail sales tax (indirect) and eliminating the income tax. I was shuttling back and forth between the Speaker of the House Dick Armey and Bill Archer who was Chairman of the House Ways & Means Committee. Dick served in Congress between January 3, 1995 – January 3, 2003. I was sitting in Dick’s office. He had his feet up on the desk with his cowboy boots while smoking a cigar. He said to me that he could not support a retail sales tax because he did not believe he would be able to terminate the income tax. He then said to me that when the political cycle would change, as I told him our computer was projecting, then the Democrats would have both taxes. It was at that moment when I gave up. I told Dick he was absolutely correct. Without restoring the Constitution to prohibit direct taxation, it was hopeless to save the future no less Social Security. I made my decision to stop the nonsense of thinking I could prevent the future economic disaster. All I could do was advise my clients to help them survive not the nation.

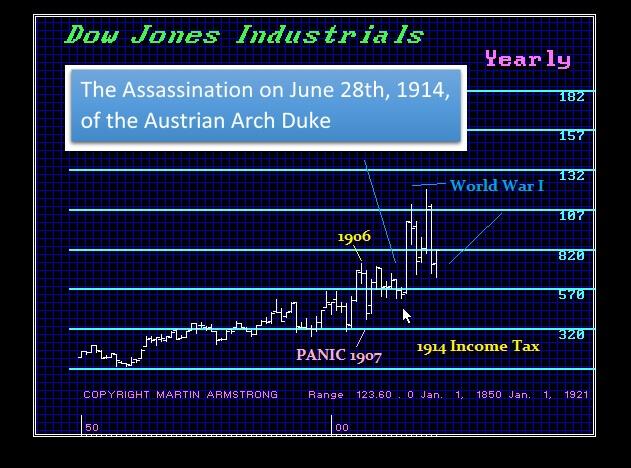

War is a great excuse, which is why politicians like war for it justifies raising taxes and introducing new powers like the Patriot Act. Make no mistake about it, when they introduced the income tax, the economy plunged into a steep recession in the face of the income tax. INVESTMENT dried up and the stock market shifted buyers. Americans were sellers and Europeans were the buyers as SMARTmoney began to move out of Europe. It had been the assassination on June 28th, 1914, in Sarajevo, Bosnia and Herzegovina of the Austrian Arch Duke which began to increase the tensions.

But a 43-month economic boom ensued from February 1915 to 1918, first as Europeans began purchasing U.S. goods for the war and later as the United States itself joined the battle. It was February 1915 is when the Ottoman forces attacked the Suez Canal and Germany defeated a Russian army in Poland. Eventually, the long period of U.S. neutrality made the ultimate conversion of the economy to a wartime base. The economic boom led to real plant and equipment expansion in response to the increased demand from both Europe and the United States.

Those who are in the “rich” category earn their money from INVESTMENT not wages. This is what Elizabeth Warren is addressing for she wants a tax on wealth – not income. So if you owned $100 million of a stock that was valued at that level because of a bull market, you will then have to pay 2% – $2 million. The stock crashes by 50%. You now pay 2% again every year of the current value of $1 million even though you lost $50 million. This type of Wealth Tax will unquestionably destroy INVESTMENT. You can lose and get no credit for a loss.

What this will do is far worse than the proposed 70% income tax for the new “Green New Deal” of Alexandria Ocasio-Cortez. This dynamic-duo of Warren and Ocasio-Cortez will absolutely complete what our model is forecasting – the end of the United States. Both are completely ignorant of how the economy even functions. They lick their lips at other people’s wealth and just want to get their hands on it to fund their wild ideas of some Green New Deal.

“The Green New Deal we are proposing will be similar in scale to the mobilization efforts seen in World War II or the Marshall Plan… Half measures will not work… The time for slow and incremental efforts has long past [sic].” – Alexandria Ocasio-Cortez, then-candidate for the U.S. House of Representatives, Huffington Post, June 26, 2018

This manifesto is very serious for they reject gradual change but are demanding immediate change to the economy. What has taken place among the Democrats is a band of newly elected members of Congress is accepting the leadership of Alexandria Ocasio-Cortez to push forward for this Green New Deal by sheer force. She is calling her proposal the most significant blueprint for system change in 100 years.

The core idea demands the mass conversion to renewable energy and zero emissions of greenhouse gases in the U.S. by 2030. Yes – Global Warming is a great excuse to raise taxes. They argue that a transition is not acceptable for it must be immediate action by the elimination of greenhouse gas emissions from our multi-trillion-dollar food and farming system they claim is long overdue because farming and cows represent a degenerative food system generates that accounts for 44-57% of all global greenhouse gases.

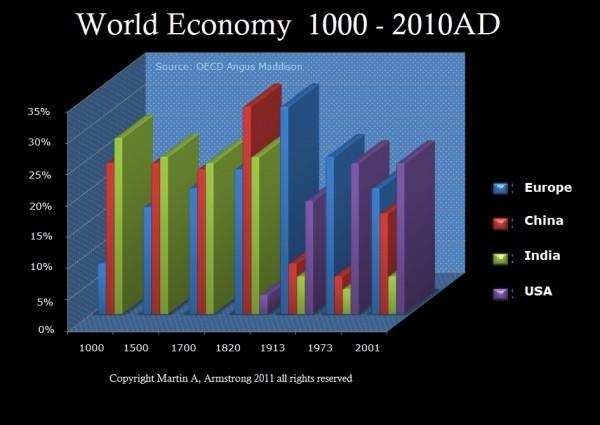

Warren’s proposal will destroy the economy and lower economic growth providing the strongest incentive for capital to migrate to China. As Europe and the United States spiral downward economically, this is how our model will be correct in the shift from the United States to China of the title – Financial Capital of the World. India and China were where all the wealth was which peaked during the early 19th century. After the fall of Rome and them Byzantium, the Financial Capital of the World began to migrate to India. That peaked by about the 14th century as India gradually declined and it moved to China.

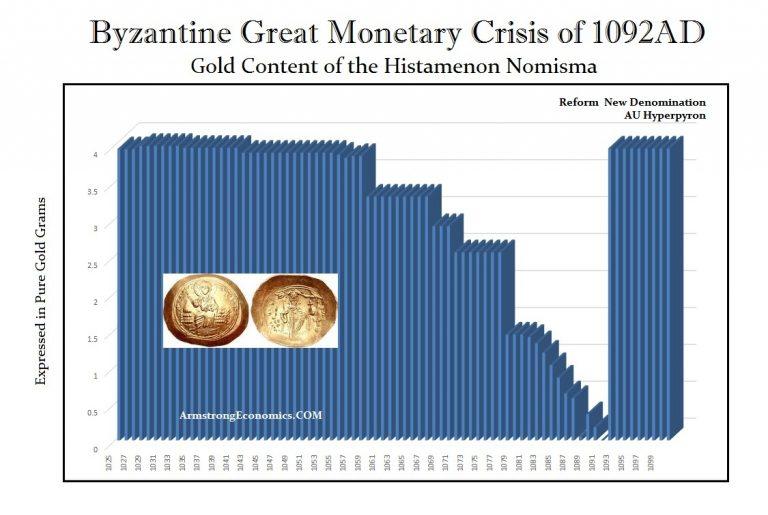

Following the Great Monetary Crisis of 1092, the Financial Capital of the World migrated to India – the land of the Spice Trade. Southern India has long imitated Roman gold coins to facilitate the local economy. We begin to see actual India coins but only under the Kushan Empire. Southern India continued to mint Roman imitations until the mid 3rd century AD. After that period, we begin to see actual India gold coins being struck showing that governments began to win the confidence of the people.

India’s economic boom period lasted about two Pi Cycles of approximately 630 years. The time period that it had captured the title of the Financial Capital of the World appears to be only about 224 years. China’s rise also lasted about 224 years. The rise of the United States has come into play for also about 224 years.

It’s just time. So thank you Warren and Ocasio-Cortez for ensuring our model will be correct once again. What these people refuse to ever look at is that the government is incapable of ever managing anything. Economic growth declines with rising taxation and regulation. No matter how many examples there are of how socialism destroys economies right down to present day Venezuela, they just cannot help themselves trying to change the very nature of human behavior. Any one who believes this tax will stay at $50 million+ is an absolute fool. History would beg to differ.

Will this end up causing a mass exodus of Americans? Yes! It will simply be time to turn out the lights and leave. This is how the United States will be destroyed like every other empire. Far too often there ends up more people in government living off the tax collections disprotionately to the living standards of the people paying taxes.

With trade talks between China and the US set to resume on January 30, when a Chinese delegation of led by Vice Premier Liu He and also includes Yi Gang, governor of China's central bank, the early warning by Commerce Secretary Wilbur Ross that the two sides remain "miles and miles" apart remains spot on because according to a WSJ update "early indications are that the two sides remain sharply divided, suggesting a hard slog ahead for a deal to be cut before a March 1 deadline."

While China is prepared to make modest, and largely cosmetic concessions, offering a big increase in purchases of U.S. farm products and energy, along with modest reforms in industrial policies, the WSJ reports that Beijing "will fight U.S. demands for deep structural changes in the Chinese economy" including the elimination of subsidies to favored industries, as well as regulatory help and other aid to Chinese companies, especially state-owned enterprises.

In response to US demands that Beijing has not done enough, Chinese officials say they have already taken concrete steps toward reform, citing more liberal rules for foreign competitors in sectors such as autos and financial services, and tougher enforcement of intellectual property, which however the US side finds insufficient. As a result, a draft negotiating document laying out terms has yet to be assembled, WSJ sources report.

Meanwhile, even those which China has agreed to - such as allowing S&P to offer credit rating services on the mainland, wouldn’t take effect immediately, as there are other bureaucratic hurdles to clear. And eliminating requirements that U.S. firms form joint ventures—a key demand for Washington, which is leery about Chinese firms and officials pressuring U.S. partners to transfer technology—is likely to stretch out over years, said people quoted by the WSJ.

Despite skepticism, markets have already priced in a favorable outcome to the talks, thanks to Treasury Secretary Steven Mnuchin who said on Monday that he expects “significant progress” to be made in the coming days. And yet, just days before the talks resumed, any optimistic mood will be overshadowed by the administration’s actions on Monday against China’s Huawei Technologies when federal prosecutors accused China's telecom giant of violating U.S. sanctions on Iran and of stealing trade secrets from a U.S. business partner, and made public charges against Huawei Chief Financial Officer Meng Wanzhou, who is fighting extradition to the U.S.

This week's talks, which will take place in the Eisenhower Executive Office Building next to the White House, are aimed at further delaying or canceling Trump's plans to raise tariffs on $200 billion of Chinese goods to 25%, up from the 10% levies imposed last year. Mr. Liu is scheduled to meet with President Trump at the end of the talks, Mnuchin said.

As noted above, the Chinese delegation also includes PBOC head Yi Gang who spent many years teaching at Indiana University, while the US side will offer a bevy of cabinet officials, including U.S. Trade Representative Robert Lighthizer, White House trade adviser Peter Navarro and Treasury Secretary Steven Mnuchin.

Despite a nebulous picture for the outcome of this week's talks, “markets have generally come to the view that tariffs won’t ratchet up and there will be some resolution down the line,” said Seth Carpenter, UBS’s chief U.S. economist. “If we go in the opposite direction, it will have a real impact on the market.”

Already China's slowing economy is sending shockwaves around the globe, with first Apple, then Caterpillar and Nvidia all complaining about a sharp drop in Chinese demand in recent months, with many claiming that tariffs are the key culprit for the slowing economy.

Nonetheless, perhaps in order to preserve some leverage, U.S. officials said Mr. Trump is prepared to raise tariffs and will rely for advice on Mr. Lighthizer, who believes such measures are necessary to get China to change. Unlike Mnuchin, who has urged to scrap tariffs as soon as possible, Lighthizer has argued in favor of keeping the 10% tariffs in place at least until China has proved that it has lived up to its promises even if the two sides reach a trade deal this week. Lighthizer regularly brings up the importance of enforcement in meetings of administration trade officials, according to National Economic Council Director Larry Kudlow.

China, meanwhile, is urging to scrap all tariffs for the simple reason that the constant threat of new or more tariffs makes economic reform politically risky for Chinese officials, while further threatening to slow down Chinese growth. Should officials make a concession to the U.S., such as handing U.S. firms licenses, they could be criticized within the Communist Party for being soft on the U.S., especially if tariffs aren’t removed in exchange.

Yet in addition to facing pushback from Trump's trade hawks, Beijing has found that while in the past it could count on U.S. business to back its demands, that support has waned as big companies complain of threats to require them to transfer technology to Chinese partners. Those companies are also trying to get along with a protectionist U.S. administration.

“From our point of view, the tariffs need to go, but realistically the administration doesn’t agree with us,” said Erin Ennis, senior vice president of the U.S.-China Business Council, a trade association of large U.S. firms. “As a consequence, the best scenario is to come up with a plan of action that includes a way to have measurable, commercially meaningful outcomes that are tied to removal of the tariffs."

How either side will be able to spin that as the favorable outcome from this week's talks, one which the market has already priced in, remains unclear. Economist John Williams warns the Federal Reserve has painted itself into a very tight no-win corner.

No matter what the Fed does with rates it’s going to be a disaster. Williams explains, “You had some very heavy selling towards the end of the year and when you saw the big declines in the stock market you also saw that accompanied by a falling dollar and rising gold prices."

"That was foreign capital which was significant fleeing our markets. So if the Fed continues to raise interest rates, and they want to do and they still don’t have rates where they want them, it’s going to intensify the economic downturn. That’s going to hit the stock market. If they stop raising rates . . . and they have to go back to some sort of quantitative easing, that’s going to hit the dollar hard. Foreign investors are going to say the dollar is going to get weaker and let’s get out of the dollar. Then, you are going to see heavy selling in the stock market.So either way they go, they created a conundrum for themselves because of the way they bailed out the banking system (in 2008-2009). At this point they don’t have an easy way out of this.”

Williams says the U.S. is already entering into a recession. Williams contends,

“The first quarter, which is the quarter we are in right now, the first quarter of 2019 likely will be in contraction partially due to the government shutdown. That is slowing the economy on top of the interest rate hikes, but the cause of the recession here is not the government shutdown. It’s the Fed hiking rates......the fundamental driving factor that was putting us into recession even before the government shutdown was the rapid rise in interest rates.”

Williams says that in the first and second quarters of 2019 do not look good.

“I think we will have back to back contractions that will give you a formal recession...Even if we did not have the government shutdown I think we would have back to back negative quarters in the first and second quarter.”

Williams also warns, “This is a very dangerous time both domestically and globally.” Maybe this is why gold and silver prices keep steadily climbing higher. Williams says,

“As things get worse here there is going to be a flight from the dollar into other currencies and in particular into gold. Gold is the long term store of wealth here...Where we are ultimately headed here the precious metals are a long term store of wealth. They preserve the purchasing power of your assets... if you have high inflation you will still have your purchasing power. With debt collapsing and currencies collapsing you are going to end up with inflation. Expanded debt is rapid money supply growth. It is debasement of the currency and debasement of the currency means inflation...It’s the type of thing that can be accelerated very rapidly if you have another crisis such as a big stock market crash. The economy is tanking and people start fleeing the dollar means you are going to be seeing rising inflation. If you see a big hit on the dollar gasoline prices will go up.”

No comments:

Post a Comment